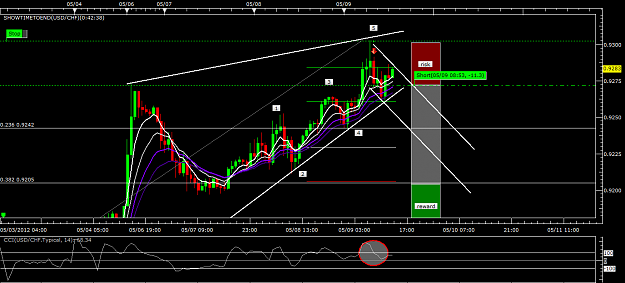

sorry, updated chart down -11 pips.

- Post #5,422

- Quote

- May 9, 2012 4:42pm May 9, 2012 4:42pm

- Joined Aug 2008 | Status: Money never sleeps | 5,878 Posts

Markets are not Random, they are designed!

- Post #5,423

- Quote

- May 26, 2012 9:18am May 26, 2012 9:18am

- Joined Jun 2010 | Status: s = k log W | 20,603 Posts

- Post #5,427

- Quote

- Jun 23, 2012 3:07pm Jun 23, 2012 3:07pm

I found the guy who keeps losing me money. Its "ME" SHOOT HIM!

- Post #5,428

- Quote

- Jun 24, 2012 5:46am Jun 24, 2012 5:46am

- | Commercial Member | Joined Feb 2010 | 13,255 Posts

- Post #5,430

- Quote

- Jul 10, 2012 2:50am Jul 10, 2012 2:50am

- | Commercial Member | Joined Feb 2010 | 13,255 Posts

- Post #5,431

- Quote

- Jul 10, 2012 3:16am Jul 10, 2012 3:16am

- | Membership Revoked | Joined Jul 2011 | 3,291 Posts

- Post #5,432

- Quote

- Jul 11, 2012 3:07am Jul 11, 2012 3:07am

- | Commercial Member | Joined Feb 2010 | 13,255 Posts

- Post #5,433

- Quote

- Oct 3, 2012 5:24am Oct 3, 2012 5:24am

- | Commercial Member | Joined Nov 2010 | 447 Posts

No I haven't got the wave structure wrong! I've corrected it!

- Post #5,435

- Quote

- Oct 4, 2012 4:27pm Oct 4, 2012 4:27pm

- | Commercial Member | Joined Nov 2010 | 447 Posts

No I haven't got the wave structure wrong! I've corrected it!

- Post #5,436

- Quote

- Oct 10, 2012 11:51pm Oct 10, 2012 11:51pm

- | Joined Jan 2012 | Status: Member | 193 Posts

- Post #5,437

- Quote

- Oct 11, 2012 12:58am Oct 11, 2012 12:58am

- | Joined Aug 2012 | Status: Member | 2,263 Posts

A 1 pip gain is better than a 1 pip loss.

- Post #5,438

- Quote

- Oct 11, 2012 1:09am Oct 11, 2012 1:09am

- | Joined Jan 2012 | Status: Member | 193 Posts

- Post #5,440

- Quote

- Oct 12, 2012 3:18am Oct 12, 2012 3:18am

- | Commercial Member | Joined Nov 2010 | 447 Posts

No I haven't got the wave structure wrong! I've corrected it!