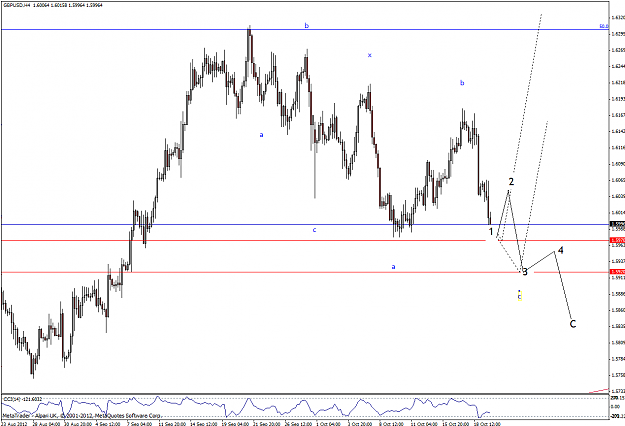

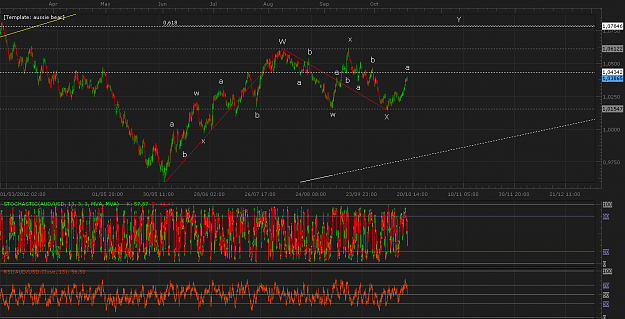

DislikedWell, not really. This pound down move is corrective, and when I was talking about the reversal, I'm expecting a new top for pound (and euro too), near 1.64, so something like shown below.

There's also divergence building up on CCI, if you wish to use other indications for reversal.

AttachmentIgnored

Stocktwit: LuisCarlos - twitter: @lcparodi