THIS should shed some light on the IDEA of Pitbull with position the aim of why we say DEMO >>DEMO >>and think ...DD control. LOSS PROFIT LOSS>

DEMO BUILDS confidence and gives you an idea of what you can achieve

It takes time, DEMO and think. NOT JUST counting the pips per trade.

This is about the concept of longer term business operation. IT's about the philosophy and not about how to enter at precision points...or which indi is better....it' about setting realistic goals... and control greed.

DEMO pitbull gives you a FAST TRACK method of practicing the concept of DD controll, hedging and LOSS profit loss.

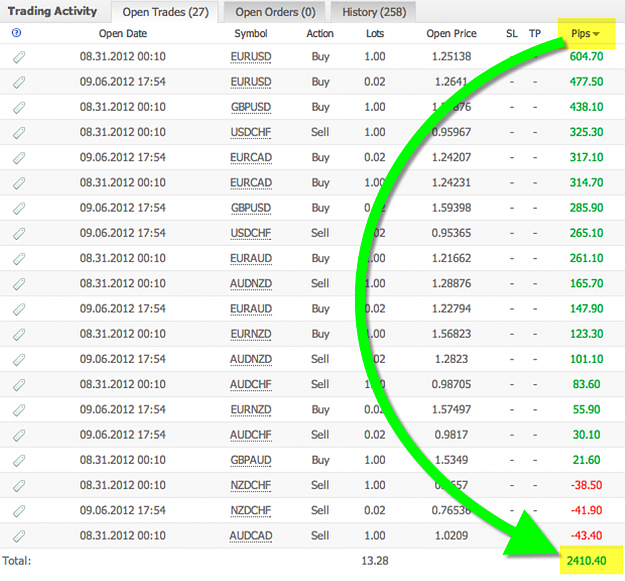

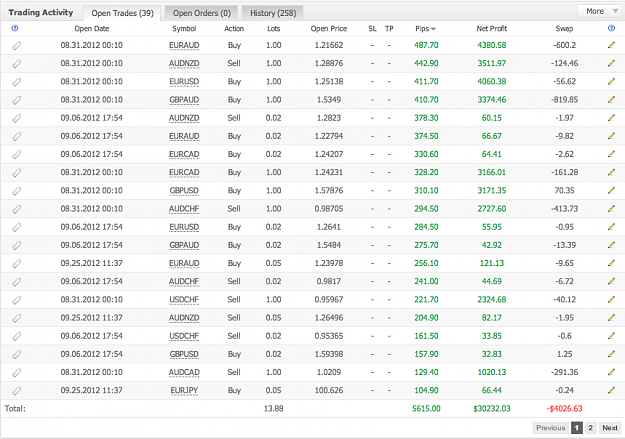

HERE I detailed where you should end up after practicing...

A. I said DEMO the method using the indicator with all the pairs..

DEMO IS FOR PRACTICE ONLY>>>TO LEARN AND THINK

WE CAN ALL TRADE WITHOUT INDICATORS AND STOP LOSSES

B. One does not need indicators to Trade..for example lets trade one pair

EUR/USD. How can we apply the pitbull trading with position building to this pair only?

c. The concept is there, think, this is for all those who have demoed.

ENTRY STARTS where IT ends and IT ENDS where it STARTS

d. At the start of the week. or day. ( we all know that price have to move, its inevitable). We have no idea where it will good, do we?

But it have to go some where either UP, DOWN or UP and Down).

e. NO STOP LOSS, we ENTER, this is the favorite part...Some where at the start of the day or week (OPEN) we enter both buy and sell. BUY above sell below.. Pay attention guys...our reference point is the OPEN.

IT's the Inevitable Movement of price that we capitalize on.

-Called ( INEVITABLE BREAK OUT).

At this point we wait...the market will move. Now only two things can happen.

1. BUY ORDER or SELL ORDER triggers.

2 BOTH ORDERS TRIGGERs

NOW THE REALLY FUN PART...

What do you do? we do what we've being doing STACKING...or SALES.

you add positions in the direction of movement(TREND) watching your account size and DD at the same time.

NOTE When both orders triggers you might say.SHIT...

think for a bit but theres no losses...it becomes a hedge trade

now PROFIT from the Hedge( losses are Frozen) STACK in your favour More BUYS or MORE SELLS profiting from the hedge...

YOur accout balance stays in tacked.

STACKING or SALES:

HOW WHEN WHERE and HOW MUCH.

HOW, in the direction of price movement ( daily, week movement) buy if it up and sell if its down.

WHEN ---GO WITH THE FLOW and BUSY times ( 0800, 1200, 1600) everyone is trading during these times..BIG MONEY)

WHERE session start...at the begining of the above sessions.

HOW MUCH..DONT be greedy...manage your position size..sometimes you dont have to make sales or stack...watch your position grow.. and DD reduce..

ITs your choice to take profit 10pips or wait of 50 or 100 or etc.( smaller pips is more trades, increase positions, increase hedges)

NOTE: LET THE MARKET GROW IN POSITIONS>>>

fast small trades are good, but account size matters in all respect, timing also...hence the PITBULL INdicator

BUY SELL ENTRIES covers all postions...and allows the STACKING PROCESS...now you are in controll if the market goes up down...we just not care ...

remember the PB indicator gives you the idea of which pair to trade NOW...

BUT buy DEMOING AND THINKING, HEDGING ,, DD control , control postion size to STAY in the market for the ride...LONGTERM BUINESS..GROWTH..

realistic growth...NOT 5% grwoth per DAY>. that's 60% growth in your account in 12 days. This seems like more trades than needed and more trades is more risk/more hedge to cover. Not good money management

I have shown how to print money non stop.but is it really good business management applying hedging all the time...without give the market time to decide how much to grow or DD the positions.. the market and us traders need time to breathe

WE have we been STACKING from our hedge trade all along.

BUT we exploit the INEVITABLE BURST of the MARKET from the START OF THE DAY OR WEEK.

AND STACK when other are ADDING...NO indicators...

EVentually we all will rest and wait for another day to start... or week.

I Break Even my postions for longterm growth ..DD control OR Take some profit to grow the account.

It better to take stock first on positions more like managing a portfolio using a What if analysis..

I really dont use shape of candles..but it's really important to know where price is for the week...UP week or DOWN week

CYCLE: LOSSS PROFIT LOSS

This is the nature of the market....Prices moves UP and DOWN...we call it the CYCLE....PREVIOUS SWING point ( S/R, PIvots etc.) These are areas where price have visited in the past...

This simple means that if you account could withstand the market movement then postions in DD could turn to profit and profit positions if not realize would decrease or be taken into DD.

This is why its important to trade like a busineess and not rush to print money,....it SO EASY...BUT STAYING in BUSINESS...is HARD.

THE TREND

The is everyones friend.

There are indicators andmethods tons of it to identify the trend.

But I'm not fixated on the Trend....the BIG picture...(I'm remain flexible in my thoughts)

My job in entering and Stacking or making sales ( important)..I can be wrong ..about my friend any day or month or week..

I just entering BUYS AND SELLS...the market goes up down BUT I have and will always maintain a Idea about the TREND..( weekly monthly)

but I enter every day...THAT IS MYJOB...I controll the DD THIS WAY

THE pitbull is what makes me realize... the Pitbull is a just the indicator...of what to trade NOW., so in essence

you can pick you favorite currency and trade it...and your career.. but diversifying is part of the business.

THINK and practice...

Use pitbull indicator as a FASTRACK Method of practicing DD control trading the forex-DEMO it is for demo..

it teaches you not focus on indicators ema, ma stoch etc.. but allows you think and apply

positions and market price movement to profit slowly steadily using business principles.

Think and refine your application.

Cheers

DEMO BUILDS confidence and gives you an idea of what you can achieve

It takes time, DEMO and think. NOT JUST counting the pips per trade.

This is about the concept of longer term business operation. IT's about the philosophy and not about how to enter at precision points...or which indi is better....it' about setting realistic goals... and control greed.

DEMO pitbull gives you a FAST TRACK method of practicing the concept of DD controll, hedging and LOSS profit loss.

HERE I detailed where you should end up after practicing...

A. I said DEMO the method using the indicator with all the pairs..

DEMO IS FOR PRACTICE ONLY>>>TO LEARN AND THINK

WE CAN ALL TRADE WITHOUT INDICATORS AND STOP LOSSES

B. One does not need indicators to Trade..for example lets trade one pair

EUR/USD. How can we apply the pitbull trading with position building to this pair only?

c. The concept is there, think, this is for all those who have demoed.

ENTRY STARTS where IT ends and IT ENDS where it STARTS

d. At the start of the week. or day. ( we all know that price have to move, its inevitable). We have no idea where it will good, do we?

But it have to go some where either UP, DOWN or UP and Down).

e. NO STOP LOSS, we ENTER, this is the favorite part...Some where at the start of the day or week (OPEN) we enter both buy and sell. BUY above sell below.. Pay attention guys...our reference point is the OPEN.

IT's the Inevitable Movement of price that we capitalize on.

-Called ( INEVITABLE BREAK OUT).

At this point we wait...the market will move. Now only two things can happen.

1. BUY ORDER or SELL ORDER triggers.

2 BOTH ORDERS TRIGGERs

NOW THE REALLY FUN PART...

What do you do? we do what we've being doing STACKING...or SALES.

you add positions in the direction of movement(TREND) watching your account size and DD at the same time.

NOTE When both orders triggers you might say.SHIT...

think for a bit but theres no losses...it becomes a hedge trade

now PROFIT from the Hedge( losses are Frozen) STACK in your favour More BUYS or MORE SELLS profiting from the hedge...

YOur accout balance stays in tacked.

STACKING or SALES:

HOW WHEN WHERE and HOW MUCH.

HOW, in the direction of price movement ( daily, week movement) buy if it up and sell if its down.

WHEN ---GO WITH THE FLOW and BUSY times ( 0800, 1200, 1600) everyone is trading during these times..BIG MONEY)

WHERE session start...at the begining of the above sessions.

HOW MUCH..DONT be greedy...manage your position size..sometimes you dont have to make sales or stack...watch your position grow.. and DD reduce..

ITs your choice to take profit 10pips or wait of 50 or 100 or etc.( smaller pips is more trades, increase positions, increase hedges)

NOTE: LET THE MARKET GROW IN POSITIONS>>>

fast small trades are good, but account size matters in all respect, timing also...hence the PITBULL INdicator

BUY SELL ENTRIES covers all postions...and allows the STACKING PROCESS...now you are in controll if the market goes up down...we just not care ...

remember the PB indicator gives you the idea of which pair to trade NOW...

BUT buy DEMOING AND THINKING, HEDGING ,, DD control , control postion size to STAY in the market for the ride...LONGTERM BUINESS..GROWTH..

realistic growth...NOT 5% grwoth per DAY>. that's 60% growth in your account in 12 days. This seems like more trades than needed and more trades is more risk/more hedge to cover. Not good money management

I have shown how to print money non stop.but is it really good business management applying hedging all the time...without give the market time to decide how much to grow or DD the positions.. the market and us traders need time to breathe

WE have we been STACKING from our hedge trade all along.

BUT we exploit the INEVITABLE BURST of the MARKET from the START OF THE DAY OR WEEK.

AND STACK when other are ADDING...NO indicators...

EVentually we all will rest and wait for another day to start... or week.

I Break Even my postions for longterm growth ..DD control OR Take some profit to grow the account.

It better to take stock first on positions more like managing a portfolio using a What if analysis..

I really dont use shape of candles..but it's really important to know where price is for the week...UP week or DOWN week

CYCLE: LOSSS PROFIT LOSS

This is the nature of the market....Prices moves UP and DOWN...we call it the CYCLE....PREVIOUS SWING point ( S/R, PIvots etc.) These are areas where price have visited in the past...

This simple means that if you account could withstand the market movement then postions in DD could turn to profit and profit positions if not realize would decrease or be taken into DD.

This is why its important to trade like a busineess and not rush to print money,....it SO EASY...BUT STAYING in BUSINESS...is HARD.

THE TREND

The is everyones friend.

There are indicators andmethods tons of it to identify the trend.

But I'm not fixated on the Trend....the BIG picture...(I'm remain flexible in my thoughts)

My job in entering and Stacking or making sales ( important)..I can be wrong ..about my friend any day or month or week..

I just entering BUYS AND SELLS...the market goes up down BUT I have and will always maintain a Idea about the TREND..( weekly monthly)

but I enter every day...THAT IS MYJOB...I controll the DD THIS WAY

THE pitbull is what makes me realize... the Pitbull is a just the indicator...of what to trade NOW., so in essence

you can pick you favorite currency and trade it...and your career.. but diversifying is part of the business.

THINK and practice...

Use pitbull indicator as a FASTRACK Method of practicing DD control trading the forex-DEMO it is for demo..

it teaches you not focus on indicators ema, ma stoch etc.. but allows you think and apply

positions and market price movement to profit slowly steadily using business principles.

Think and refine your application.

Cheers