DislikedGood to see your back Courtney Shame the thread got trashed, but hey ho.. Interesting that several basket threads are floating around, some are looking for.... the fastest moving pair... Not exactly pitbull, but the end result is the same, they also use hedged pairs etc and no stops,, funny how those threads dont get trashed , lol Be good to get some action back on this thread and bounce some ideas, any news from chips?? M.Ignored

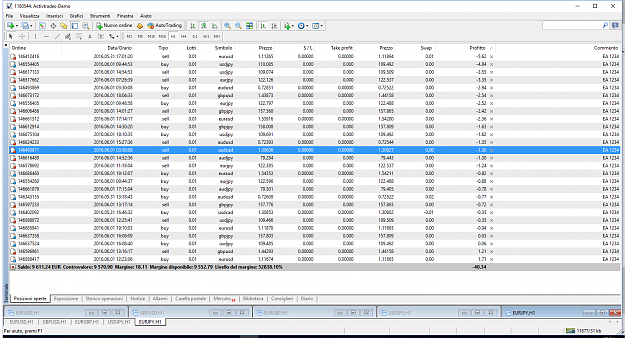

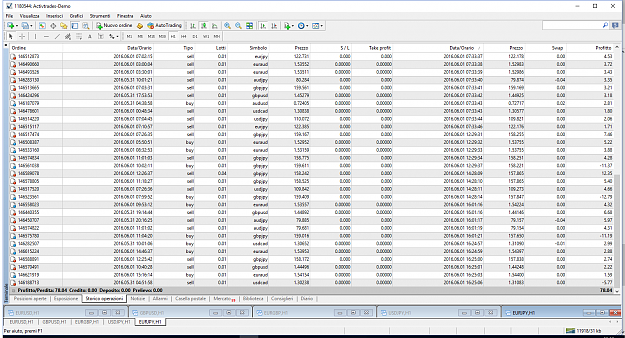

Revisiting pit this week and today put a tiny account live to practice; and +8.6% today so happy with that.

I have no clue on Chips