DislikedDear Bassramy,

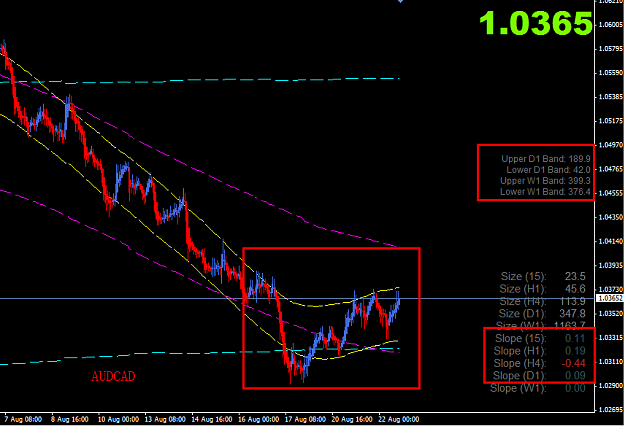

Thank you very much for your information. Just one qestion? You are looking H1 chart. do you have h1 - h4 - d1 sloppy OR m15 - h1 - h4 sloopy could you reply me.

Best regards.

BülentIgnored

Master Your Setup, Master Your self. (NQoos)