DislikedGood trade mate; what I like the most is how much room you gave it.....in the worst case you would lose 0.5 unit as I imagine you would exit if it broke above the Asian range?........and not being to greedy gives you a much smoother equity curve!Ignored

you are absolutely right that I am watching PA if it rebound and move above the Asian H. I would cut loss early.

Took me a long time to learn how manage the fear and greed factors while trading....still struggle with these everytime.

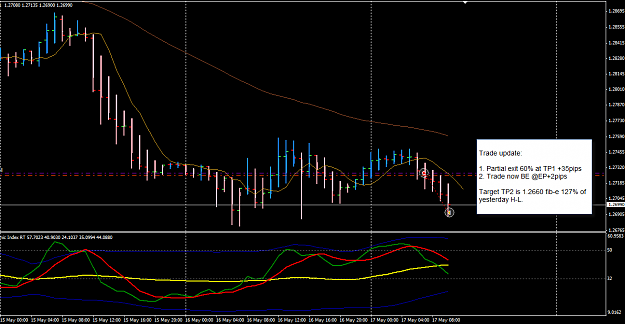

For the benefit of others, the initial SL was -35pips (R), and I looked at the ATR(10) on both H1 and H4. Yesterday was narrow range, so it is either I take the ATR(10) on H4 which is about 37pips or 2xATR(10) on H1 which is 2x14pips. In the end, it is 3 pips above yesterday's high.

This trade is now BE with 60% exit at +35pips. Nice timing one hour before NYO.

regards,

Honesty is a very expensive gift. You wont find it in cheap people.WBuffett