DislikedHi,

which SHI channel indicator do you use?

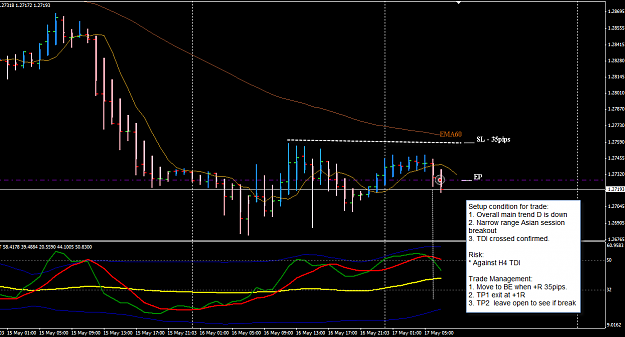

I draw my own channel, see attached chart for example.

the channel will give you a projection where price can go.

Also you need to look at the price action on higher TF like D to see the candle pattern. Yesterday's D candle closed quite strong bullish. So we expect to see follow through.

There is also week 18 high 0.9330 which can provide support for continuation.

regards,Ignored

Hi Emmanuel,

Here is usdyen daily setup I guess, there is a very bullish daily candle yesterday too.

Is this a right way to pick long term trades ? What do you think ?

Regards,

Okan