Hello everybody.

Im posting my new strategy here, this is my first post in this site and I wish you happy pips with it.

I used (IBFX) to perform the back test.

Here's the deal.

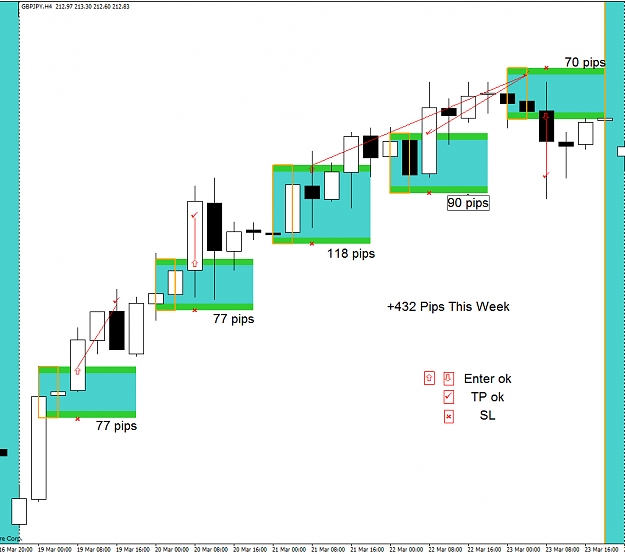

1. Open the 4 hour chart

2. Take the Hi and Lo of the second candle of the day (GMT)

3. Place an Buy order 10 pips above the Hi and 10 pips below the Lo

(you can use the Eagle Breakout Indicator for easy visualization)

4. When the price hit an order cancel the other.

5. You should place your SL at the other side of the channel.

(don't enter the trade if the channel is more than 200 pips)

6. You should place the TP at the size of the channel.

7. Close the trade at the end of the week if given the case.

8. If your trade is still on by the next breakout stay in until you lose or win.

This baby gave me in my manual backtest in 2007 around 4658 pips. This sitem can be improved if someone want to try a diferent strategy or maybe a Breakeven or SL. Anyway I guess is a very profitable system. Try it on a demo or backtest to check by yourself. Any sugestion is welcome as weel as for backtest for other currencies and other years.

Well I guess that's all for now, I leave you my monthly results.

2006

Jan: -447

Feb: +458

Mar: +63

Apr: +231

May: -153

Jun: -106

Jul: +383

Aug: +622

Sep: +60

Oct: +194

Nov: -7

Dic: +302

TOTAL: 1598 Pips

2007

Jan: +278

Feb: +333

Mar: +1107

Apr: +366

May: +343

Jun: +726

Jul: -412

Aug: +349

Sep: +428

Oct: +776

Nov: +280

Dic: +114

TOTAL: 4658 Pips

2008

Jan: -278

Feb: +113

Mar: +434

Apr: +432

May: -240

Jun: still on

Jul:

Aug:

Sep:

Oct:

Nov:

Dic:

Im posting my new strategy here, this is my first post in this site and I wish you happy pips with it.

I used (IBFX) to perform the back test.

Here's the deal.

1. Open the 4 hour chart

2. Take the Hi and Lo of the second candle of the day (GMT)

3. Place an Buy order 10 pips above the Hi and 10 pips below the Lo

(you can use the Eagle Breakout Indicator for easy visualization)

4. When the price hit an order cancel the other.

5. You should place your SL at the other side of the channel.

(don't enter the trade if the channel is more than 200 pips)

6. You should place the TP at the size of the channel.

7. Close the trade at the end of the week if given the case.

8. If your trade is still on by the next breakout stay in until you lose or win.

This baby gave me in my manual backtest in 2007 around 4658 pips. This sitem can be improved if someone want to try a diferent strategy or maybe a Breakeven or SL. Anyway I guess is a very profitable system. Try it on a demo or backtest to check by yourself. Any sugestion is welcome as weel as for backtest for other currencies and other years.

Well I guess that's all for now, I leave you my monthly results.

2006

Jan: -447

Feb: +458

Mar: +63

Apr: +231

May: -153

Jun: -106

Jul: +383

Aug: +622

Sep: +60

Oct: +194

Nov: -7

Dic: +302

TOTAL: 1598 Pips

2007

Jan: +278

Feb: +333

Mar: +1107

Apr: +366

May: +343

Jun: +726

Jul: -412

Aug: +349

Sep: +428

Oct: +776

Nov: +280

Dic: +114

TOTAL: 4658 Pips

2008

Jan: -278

Feb: +113

Mar: +434

Apr: +432

May: -240

Jun: still on

Jul:

Aug:

Sep:

Oct:

Nov:

Dic:

Attached File(s)