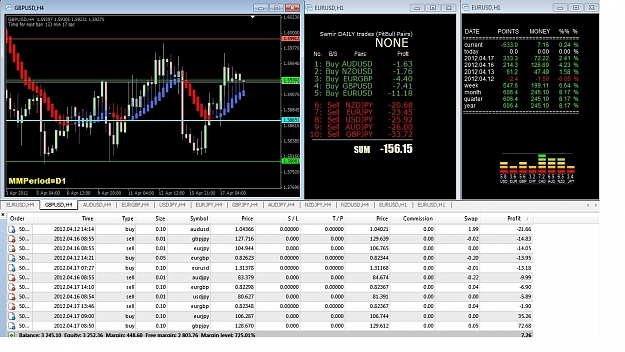

Using the 4h chart...and common points..HH and LL.

One can use limit orders at these points to take advantage of swings.

I use the square indicator of the last 48 bars...to identify the HH and LL like Brijon showed.

it works....with patience on any pairs...

Somtimes the trend is so strong it blows through these points but controll the DD..because Sellers will jump in bring price back to where the masses think it's not over price.

The hardest part is controlling greed

One can use limit orders at these points to take advantage of swings.

I use the square indicator of the last 48 bars...to identify the HH and LL like Brijon showed.

it works....with patience on any pairs...

Somtimes the trend is so strong it blows through these points but controll the DD..because Sellers will jump in bring price back to where the masses think it's not over price.

The hardest part is controlling greed