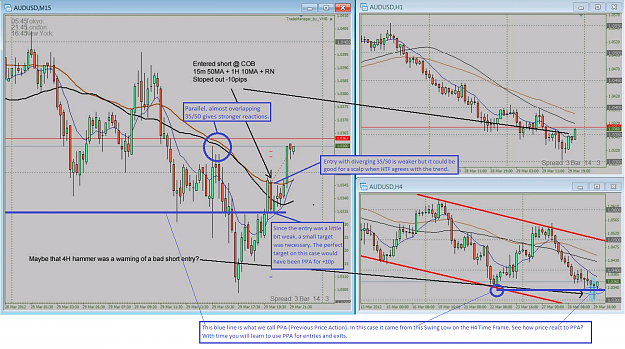

Today I took a losing trade on the AU , I'm posting the chart to get some feedback from the more experienced guys since I still not sure what went wrong with the setup. From my limited analyses looked like a pretty strong entry, but later I realised that a hammer was about to be printed on the 4H TF, maybe this was a warning signal of a bad short entry? Anything else I'm missing or this is just part of the game?

Thanks in advance

Thanks in advance