DislikedHi gents,

following the thread for a week and wanna try to apply the approach to my demo trading. Need an expert view on my thoughts as I'm seeking for possible setups.

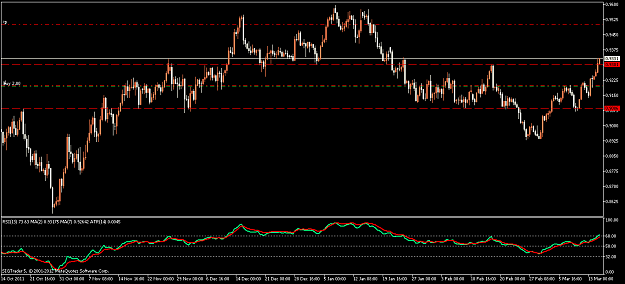

If the bar closes beneath the MA will it be a possible setup? ATR(1)/ATR(7) ration looks pretty good, candle pattern is 'Three inside down', 55 MA are heading down.

Or it's better to wait for PA & 200 MA collision result? Besides that tomorrow is Friday & NFP

What do you master Brit recommend?Ignored

Trading the Friday candle is an interesting challenge and you have to decide whether you want to set a trigger point for a trade based on the Friday candle move. Sunday will be the first opportunity to set all this up unless you act in the next hour of the Friday market.

Also, you are looking at a challenge of the 200EMA

Firtly I do not trade on Fridays - Secondly this is more than likely to have a 200EMA bounce, seeing as the previous moves either never break or did not hold - previous 200EMA break only held for 120pips for a few days.

Following NFP, there may well be a gap on Sunday and that is a coin flip.

Although I like the Friday move I want to see a close below the 200EMA - there may be a possibility of a 100 pip trade on the short side before you run into resistance, so for me this is not an A+ trade and it's Friday. The only way I would trade this would be if the previous Fractal Lows were farther away 200 - 300pips.

"To live with Passion, it takes Courage and Grace to survive"