DislikedHello Guys,

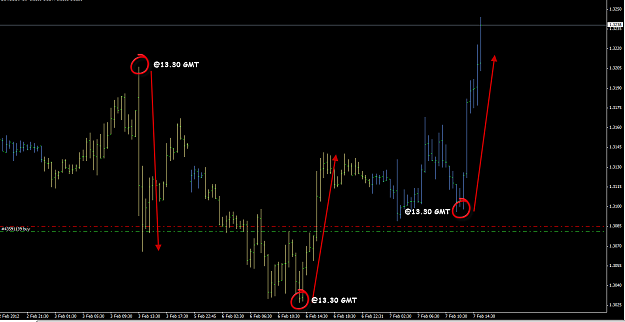

I want to share with you my today's experience I have gained trading eurusd. Maybe it will be of use to someone.

LESSONS LEARNED:

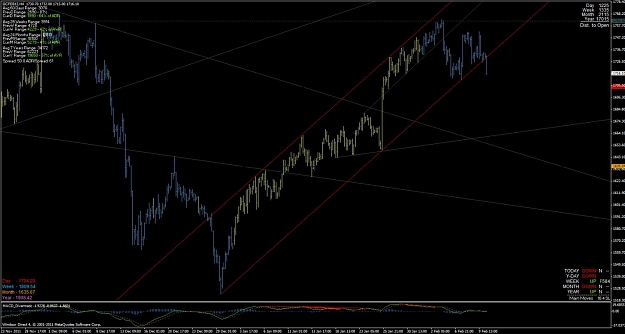

1. USING RANGE TEMPLATES KEEP YOUR STOP UNDER DAILY LOW, IT'S A REALLY GOOD PLACE. DON'T DEFEND YOUR POSITION TOO EAGERLY.

2. TIMING IS REALLY IMPORTANT, ESPECIALLY USING 18.4 TEMPLATE. FOR SURE IGROK HAD A LOT OF REASONS TO WRITE IN HIS BOOK THAT IT SHOULD BE PLAYED IN VERY LATE EURO SESSION AND NY SESSION

DESCRIPTION OF TRADE MANAGEMENT:

From the very beginning of the day I planned...Ignored

PS. i wrote a post to my blog how to spot these cycles with ATR if anyone is interested http://forexworksheet.com/timing-the-intraday-volatility-increasing-trading-perfomance/