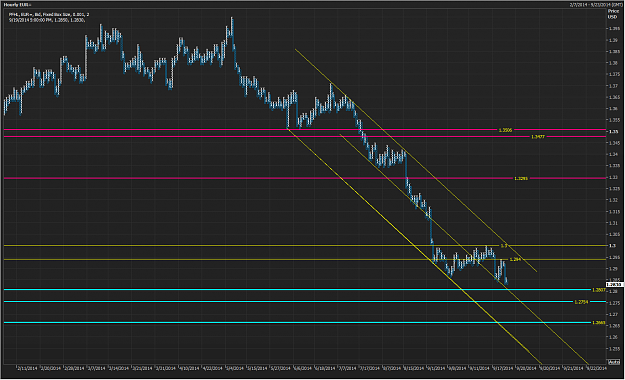

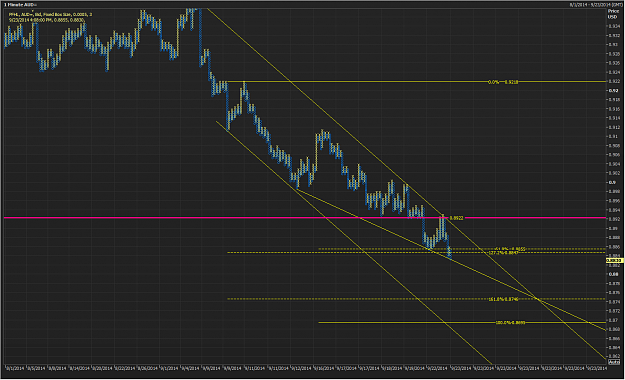

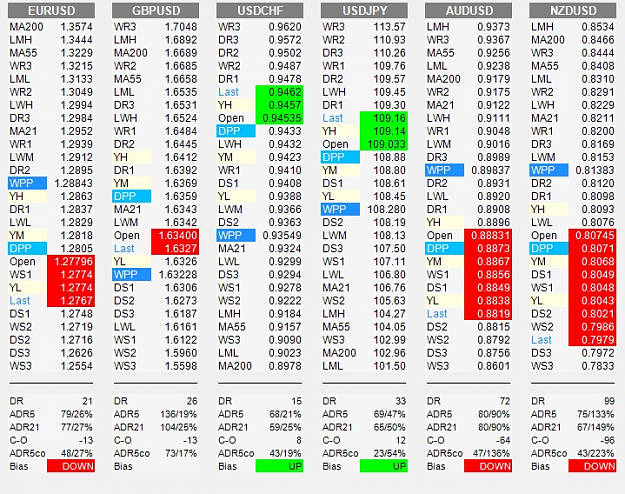

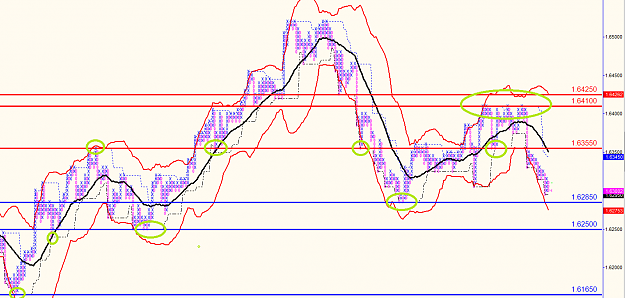

EURUSD: Short Term levels.

Support to watch 1.2805/10 - 1.2755 - 1.2665

Resistance: 1.2940/60 - 1.3000/35

To relieve the bearish pressure, we would need to go back above 1.2940/60 to test the more important 1.3000/35. Until then SELL rally ( ideally) with a S/L 1.2975 or 1.3055

Week End News:

Support to watch 1.2805/10 - 1.2755 - 1.2665

Resistance: 1.2940/60 - 1.3000/35

To relieve the bearish pressure, we would need to go back above 1.2940/60 to test the more important 1.3000/35. Until then SELL rally ( ideally) with a S/L 1.2975 or 1.3055

Week End News:

- Current proposed G20 growth measures would add 1.8 pct to global growth by 2018 - german g20 source

- Germany's Schaeuble sees potential risk of bubbles in share and real estate markets - german g20 source

- Schaeuble underlined need for structural reforms and consolidation to foster sustainable growth - german source

- German fin min Schaeuble sees solid fiscal policy necessary to create room to act if risks materialize

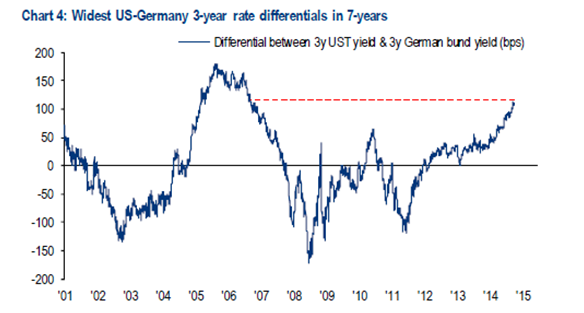

Noyer says QE not on ECB agenda at the moment

- ECB waiting for results of current stimulus steps

- Noyer says euro zone "certainly not in deflation"

- But inflation too low for too long is "is dangerous"

Weaker euro would be helpful to restore price stability