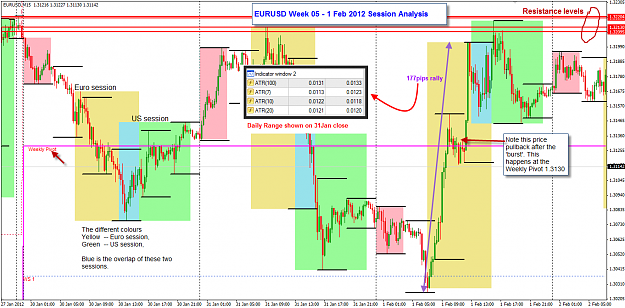

My trade performance for EURUSD week 05.

Total No. Trades 12

No. Wins 9

Total pips Wins 305.0

No. Losers 3

Total pips Losers -32.0

Avg Trade Time Overall 4H, 32m

Avg Trade Time Wins 2H, 49m

Avg Trade Time Losers 9H, 43m

Avg R per trade 3.18

Let's see if next week will give better resulst as I plan to focus more using S3 next week.

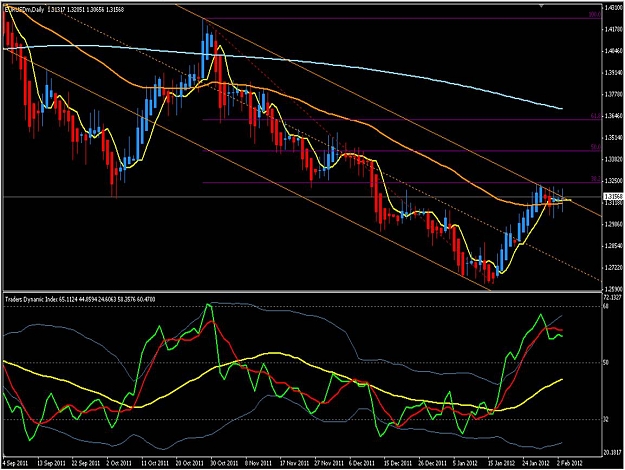

This week was a consolidation week for EURO with swing level 1.3130 being the weekly pivot.

Wish you all a Good Trading week.

Total No. Trades 12

No. Wins 9

Total pips Wins 305.0

No. Losers 3

Total pips Losers -32.0

Avg Trade Time Overall 4H, 32m

Avg Trade Time Wins 2H, 49m

Avg Trade Time Losers 9H, 43m

Avg R per trade 3.18

Let's see if next week will give better resulst as I plan to focus more using S3 next week.

This week was a consolidation week for EURO with swing level 1.3130 being the weekly pivot.

Wish you all a Good Trading week.

Honesty is a very expensive gift. You wont find it in cheap people.WBuffett