DislikedI think you should rename your thread...this stuff has nothing to do anymore with the original "Trading Made Simple"...

You don't even use the "heart" of Big E's system...the TDI!! Oh man...:-(Ignored

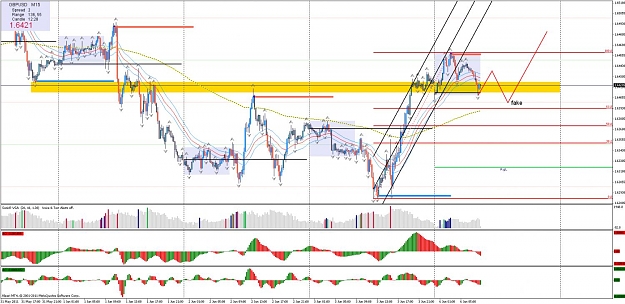

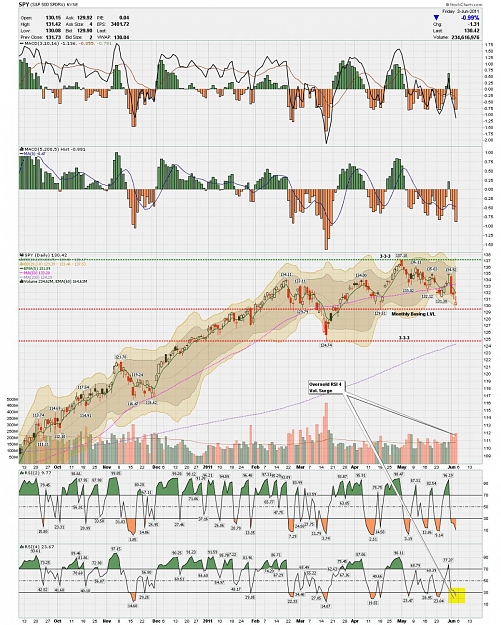

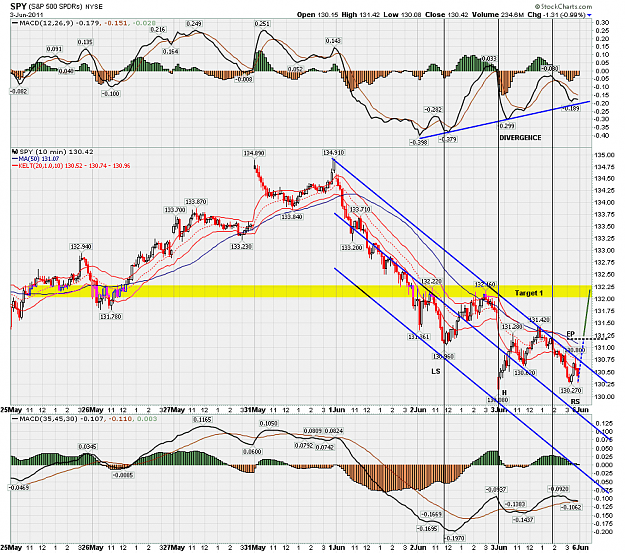

I personally use TDI as a trigger, but all my analysis is performed on my other charts which are easier for me to observe price action.

Regards,

snu