DislikedDean,

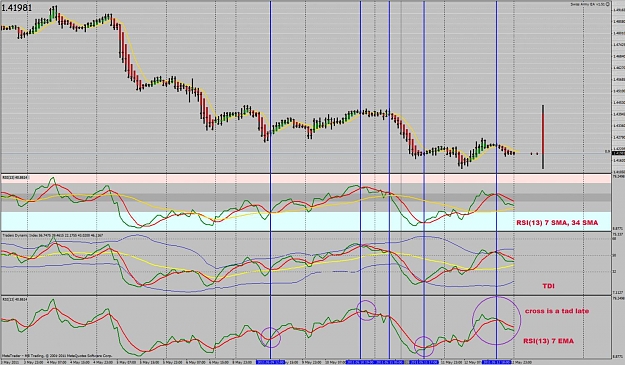

Try fib extensions for exiting and setting profit targets. I took exactly the same trade as you this morning on the EURUSD H1 at the immediate cross of the TDI (marked by the vertical green line). I stayed in the trade (although some minutes later the TDI had turned) due to the following reasons:

1) There was a sustained downtrend previously, prior to consolidation.

2) There was strong resistance in the area of 1.4236.

3) Weekly and Daily chart still in downtrend

4) The use of Fib extension allowed me to guage potential targets at 23.6...Ignored

SO using your method of TP and SL....do you have any idea what your average TP is and your max drawdown in winning trades??