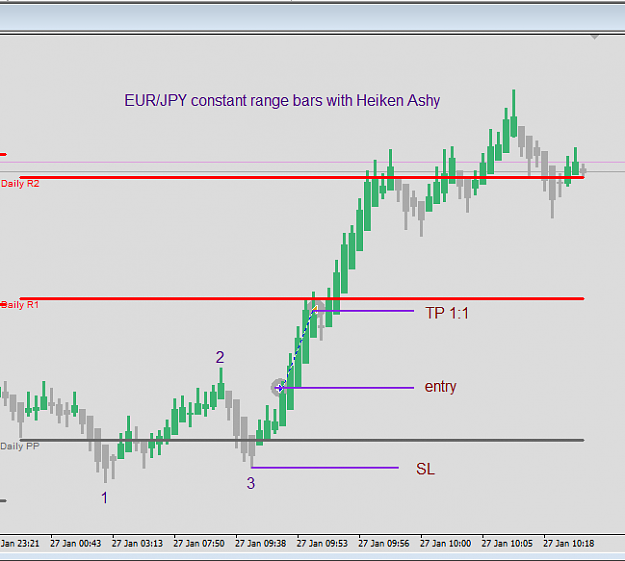

experimenting with the classic 123 setup: this is a 123 long trade on eur/jpy set at constant range bars 7, with Heiken Ashy. it's an aggressive entry before the break of point 2, based on the long and flat-bottomed HA body, which signals buying strenght. my sl was at point 3.

this time i went for a mere 1:1 r/r, as i hardly know this pair. obviously, as confidence grows, i'm planning to improve on this.

this time i went for a mere 1:1 r/r, as i hardly know this pair. obviously, as confidence grows, i'm planning to improve on this.