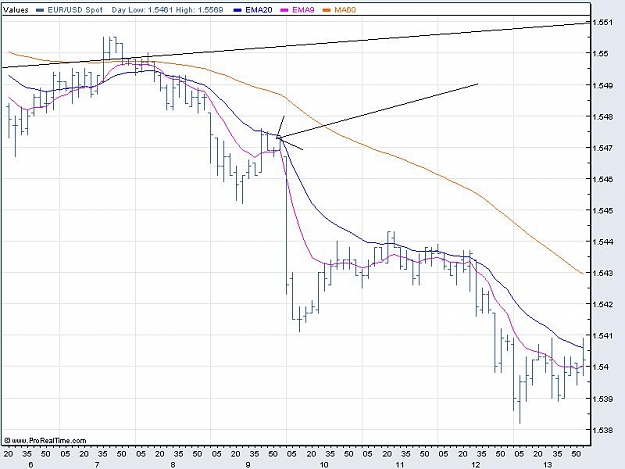

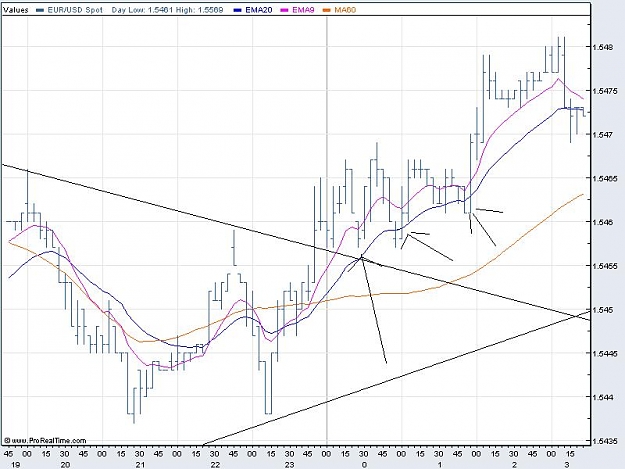

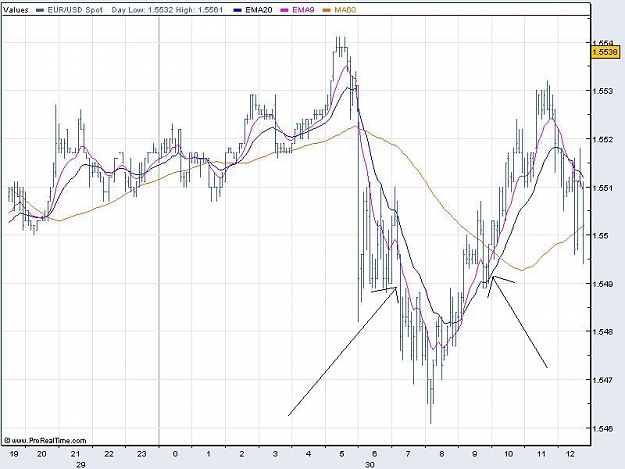

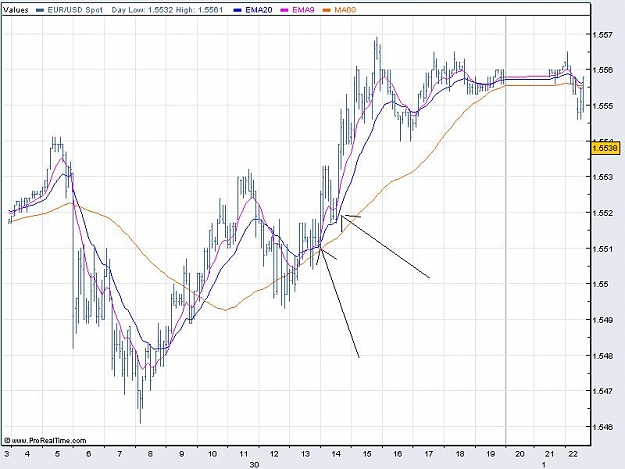

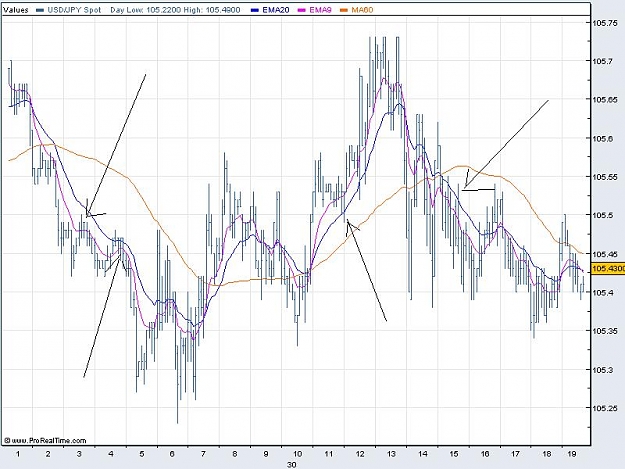

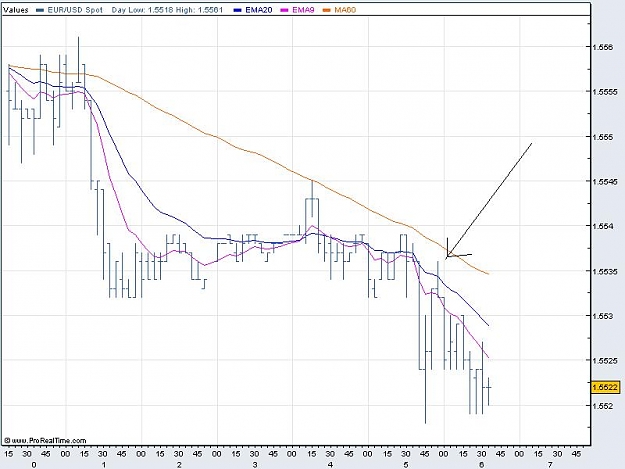

The 9/20 EMA setup has been a popular setup for a long time and it still works. However like all setups, they have their hits and misses. I have used them for a long time with good success.

The setup originated from Mike Bruns as mentioned by a forumer, and credit goes to him for such a powerful setup.

Here I shall attempt to list out all possible considerations in order to minimize the drawbacks. Under individual posts, I will list out the considerations as orderly as possible.

Coupled with very recent chart examples, I hope to create a sharing and learning platform towards the use of this setup.

The pairs discussed here will be EUR/USD, USD/CHF, USD/JPY with an intraday perspective.

Regards,

mt

The setup originated from Mike Bruns as mentioned by a forumer, and credit goes to him for such a powerful setup.

Here I shall attempt to list out all possible considerations in order to minimize the drawbacks. Under individual posts, I will list out the considerations as orderly as possible.

Coupled with very recent chart examples, I hope to create a sharing and learning platform towards the use of this setup.

The pairs discussed here will be EUR/USD, USD/CHF, USD/JPY with an intraday perspective.

Regards,

mt