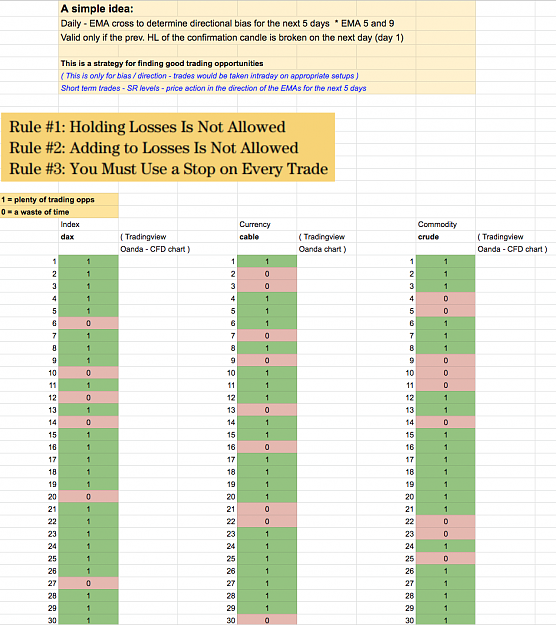

A simple idea:

Daily - EMA cross to determine directional bias for the next 5 days * EMA 5 and 9

Valid only if the prev. HL of the confirmation candle is broken on the next day (day 1)

This is a strategy for finding good trading opportunities

( This is only for bias / direction - trades would be taken intraday on appropriate setups )

Short term trades - SR levels - price action in the direction of the EMAs for the next 5 days

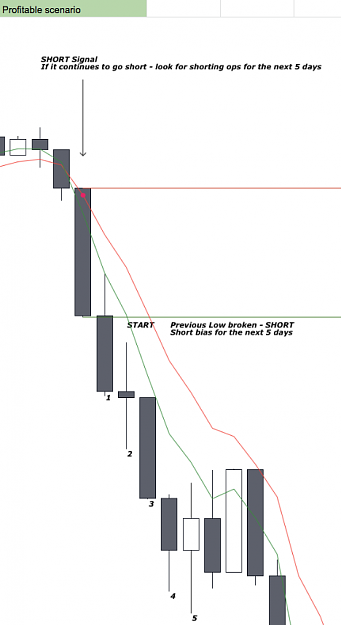

PROFITABLE SCENARIO ( short signal - looking for short trades for the next 5 day )

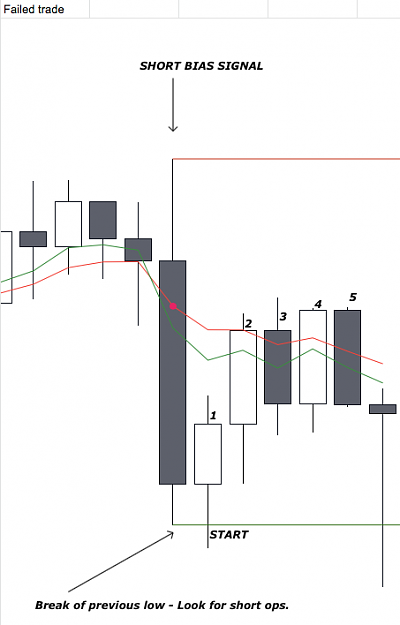

" WASTE OF TIME " SCENARIO ( short signal - next candle broke the LOW but then went nowhere )

NO TRADES SCENARIO ( buy signal but the next day's candle didn't break the HIGH of the confirmation candle )

Here are some statistics on 3 financial instruments ( 1 index, 1 currency and 1 commodity )- based on the 30 most recent trades

Again, this is just for directional bias - use your own strategy intraday or you can try to adapt it to a swing trading strategy, but the confirmation candles usually are quite large, SL would have to be quite wide and TP at least to x1 of the candle's length in order to give you a good R.

But have fun with it, it's easy to backtest on your favourite financial instrument.

Daily - EMA cross to determine directional bias for the next 5 days * EMA 5 and 9

Valid only if the prev. HL of the confirmation candle is broken on the next day (day 1)

This is a strategy for finding good trading opportunities

( This is only for bias / direction - trades would be taken intraday on appropriate setups )

Short term trades - SR levels - price action in the direction of the EMAs for the next 5 days

PROFITABLE SCENARIO ( short signal - looking for short trades for the next 5 day )

" WASTE OF TIME " SCENARIO ( short signal - next candle broke the LOW but then went nowhere )

NO TRADES SCENARIO ( buy signal but the next day's candle didn't break the HIGH of the confirmation candle )

Attached Image

Here are some statistics on 3 financial instruments ( 1 index, 1 currency and 1 commodity )- based on the 30 most recent trades

Again, this is just for directional bias - use your own strategy intraday or you can try to adapt it to a swing trading strategy, but the confirmation candles usually are quite large, SL would have to be quite wide and TP at least to x1 of the candle's length in order to give you a good R.

But have fun with it, it's easy to backtest on your favourite financial instrument.

@PocketMoneyInv on Twitter