DislikedWithout explaining how these levels are determined, what value are they to newbies or anyone else?Ignored

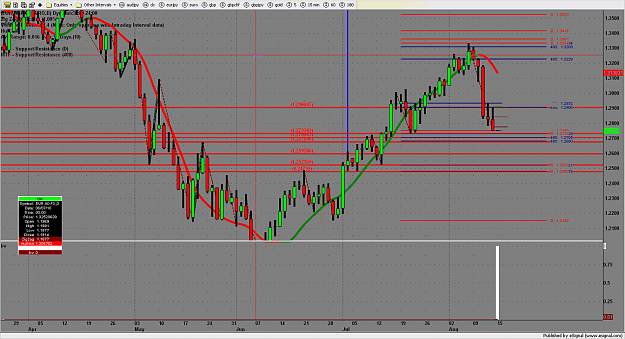

the support levels when broken will act as resistance. market basics. When a support level is broken , 90% of time on a 15 min price will come back and retest it on a low vol up bar for entry

for those trading a higher time you could place an order just under the resistance levels , with a stop 100 pip above it ( of course you there is a chance of getting a fake break down)

How r the level determined. .. this chart will show that.. pretty basic stuff and something that everyone should know... just though I would be good enough to post the chart to make it easy on those traders that might be new to the market and struggle with this.

the indie did miss one but is updated every 8 hours and as we move down would have printed the 2600 as a support.

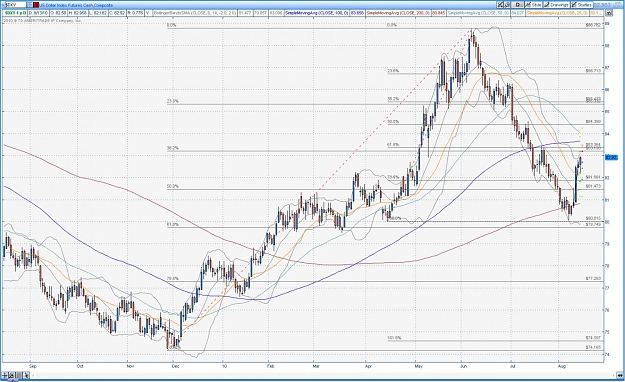

If you like you can almost think of s.r as not lines but zones.. look at 2500 are , there is one daily line at 520 , one at 480 ... this is the zone to look for bounces or break of for lower then 2500 area.

Blogging daily now at www.volume.zone