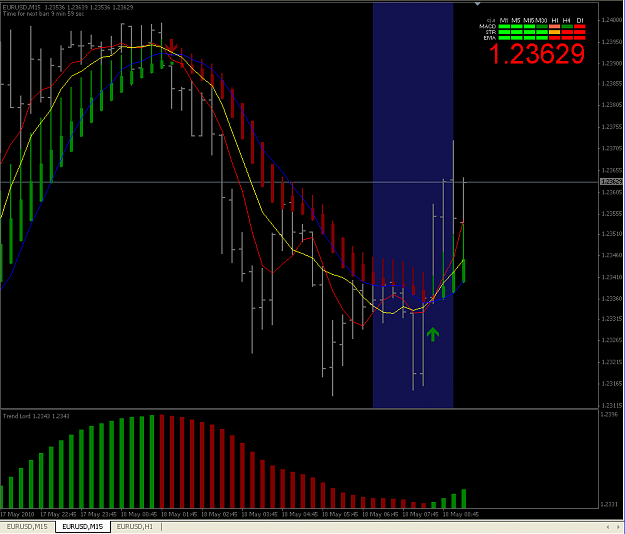

EURO-DOLLAR: Opened Asia around $1.2395, marked session highs at $1.2401

before coming fresh downside pressure. Japanese sales of euro-yen led

the move lower, the rate dropping down to $1.2314 (61.8%

$1.2254/1.2415). The fresh risk aversion seen prompted after the US

Senate passed a measure overnight that would require the Treasury to

certify that loans to certain countries are repaid, and force the

Treasury to vote against any IMF loan to a country that was unlikely to

repay. Rate recovered off lows, edging up to $1.2340/45 before fresh

selling emerged to take rate back to retest lows. Second recovery was

able to extend above $1.2345 to $1.2362, with rate holding these gains

into early Europe. Resistance seen at $1.2364 (50% $1.2415/1.2314) a

break above to allow for a move on toward $1.2375/80 ahead of

$1.2400-$1.2415, with stops placed on a break of $1.2420. Support

remains at $1.2315, with demand said to extend toward $1.2300.

Provided by: Market News International

before coming fresh downside pressure. Japanese sales of euro-yen led

the move lower, the rate dropping down to $1.2314 (61.8%

$1.2254/1.2415). The fresh risk aversion seen prompted after the US

Senate passed a measure overnight that would require the Treasury to

certify that loans to certain countries are repaid, and force the

Treasury to vote against any IMF loan to a country that was unlikely to

repay. Rate recovered off lows, edging up to $1.2340/45 before fresh

selling emerged to take rate back to retest lows. Second recovery was

able to extend above $1.2345 to $1.2362, with rate holding these gains

into early Europe. Resistance seen at $1.2364 (50% $1.2415/1.2314) a

break above to allow for a move on toward $1.2375/80 ahead of

$1.2400-$1.2415, with stops placed on a break of $1.2420. Support

remains at $1.2315, with demand said to extend toward $1.2300.

Provided by: Market News International

Trade on your own risk

Plan your trade&trade your plan dont be a