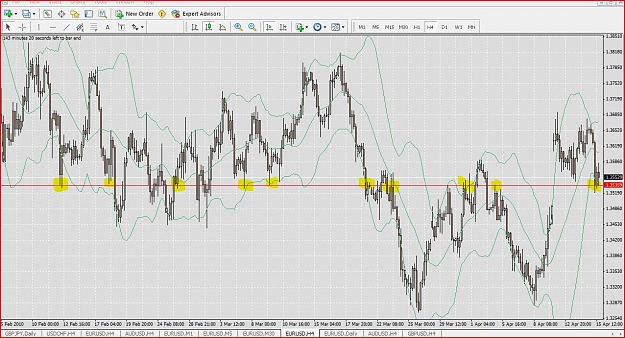

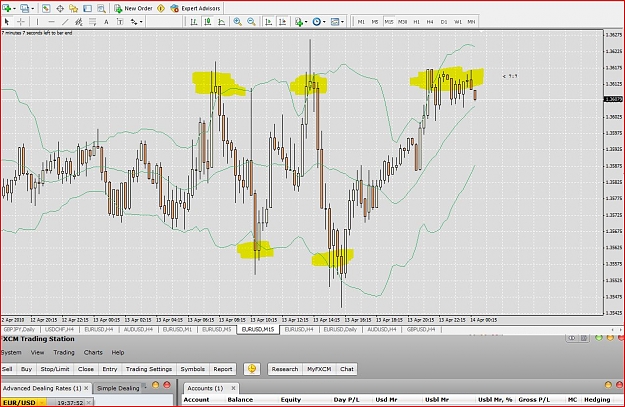

Dislikedya thats why i asked..and noi only read the first two pages...well i can either play it safe close two euro trades for 40 pip combined or play the devils game...i have very bad mm, but i manage with tight stops...if the next available price is true then its a no brainer..i might keep my eurgbp long, close the eurusd...i have 9 minutes to decide

Ignored

Inserted Video

Si vis pacem, para bellum.