DislikedAnyone every notice that:

EUR moves most during LONDON open

USD moves most during NY open

JPY moves most during TOKYO open

AUD moves most during SYDNEY open

????

Does it not make sense then to trade EUR/JPY from Tokyo open to London close?

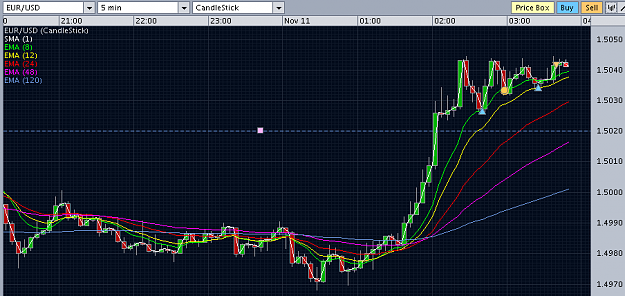

Does it not make sense then to trade EUR/USD from London open to NY close?

Does it not make sense then to trade AUD/USD from NY open to Sydney close?

Does it not make sense then to trade USD/JPY from NY open to Tokyo close?

Does it not make sense then to trade EUR/AUD from Sydney open to London close?...Ignored

Cheers.

Cory