Hi everyone, not sure who will end up reading this, if anyone, but I have more time on my hands now to do some short-term trading, as I have mostly been a long-term trader. I want to test an approach for my own personal benefit, but perhaps your input could help me out as well.

I am not reinventing the wheel here. Today was my first day of trying my strategy, and it turned out well. Just want a place to document my progress. This means I am not trying to teach anyone how to trade!

My Rules:

I am not reinventing the wheel here. Today was my first day of trying my strategy, and it turned out well. Just want a place to document my progress. This means I am not trying to teach anyone how to trade!

My Rules:

- EUR/USD only

- Only trade from 00:30-14:00 CST

- 5-minute chart

- $100 account (See post #32)

- 5 EMA's (8,12,24,48,120)

- BE PATIENT, wait for a trend and wait for the right time to enter it (near MA's).

- Check 1-hour chart for flat markets. If price is consolidating in a 100 pip or less range, then wait for movement to resume trading.

- take profit 100 pips, 10 pip trailing stop

- risk max units rounded down to nearest 1,000. For instance, my max units is 1400, so order 1000 because it is rounded down to nearest 1000.

- Don't trade 1 minute after I wake up

(have focused mind)

(have focused mind)

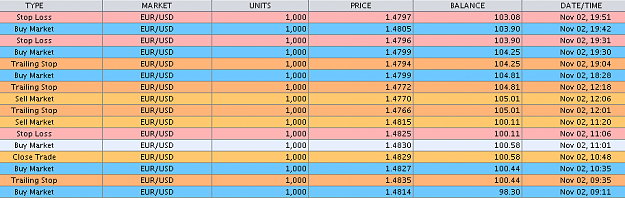

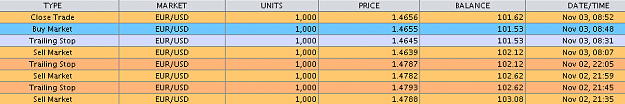

Probably each day going to post results, good, bad and ugly. I expect to lose a lot but just a little each time, and win pretty big. Only concrete result I have to back this up are a nice 60 pip trade and 20ish pip trade I had today. Blah blah, let's just show the trades I took today and the results they produced.

Good luck to me, and anyone else trading forex