DislikedKevin,

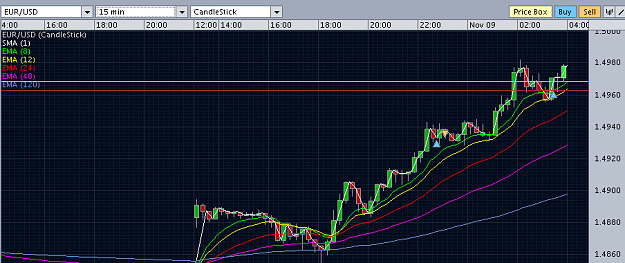

Think of the mas as a trendline and take trades right off of those at the candle close, I would stay away from bigger candles. So for your last trade the signal would have been a short because price ran up and then got beat down below the mas.Ignored

You are very generous to stop by to give me feedback on my trading, man. Really appreciate how constructive and helpful it is. What you say makes total sense.

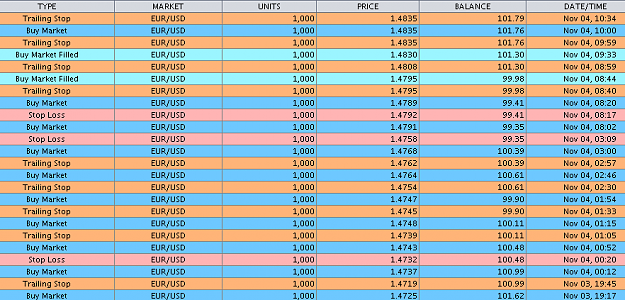

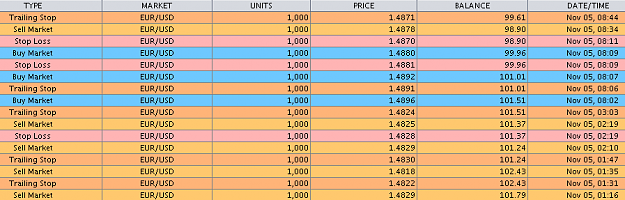

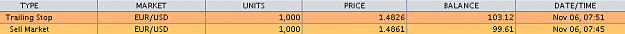

Just one minute to read your last post and I scored 2 decent trades after getting one more dumb trade out of my system, basically using your method. Hope you continue to stop by

Thanks,

Kevin