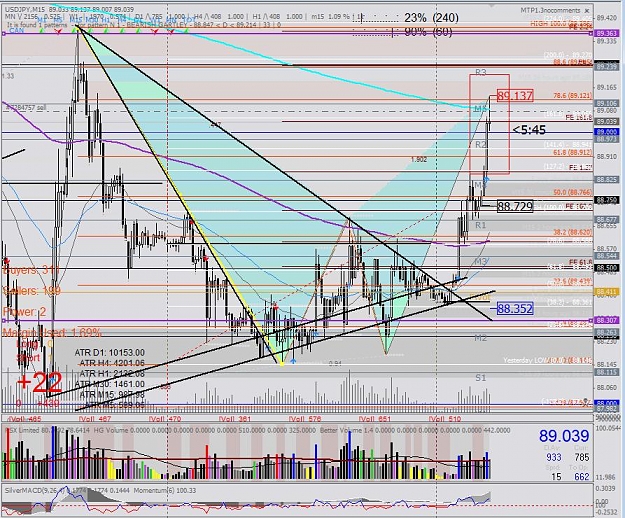

price is test 88.50 again. since it broke last night it won't be such a shock this time.

- Post #13,261

- Quote

- Oct 7, 2009 7:45pm Oct 7, 2009 7:45pm

- | Joined Jul 2008 | Status: Clear Cut System Trader | 1,111 Posts

- Post #13,262

- Quote

- Oct 7, 2009 7:57pm Oct 7, 2009 7:57pm

- | Commercial Member | Joined Feb 2008 | 1,440 Posts

- Post #13,264

- Quote

- Oct 8, 2009 5:29am Oct 8, 2009 5:29am

- Joined Apr 2009 | Status: RETIRED | 1,947 Posts

- Post #13,265

- Quote

- Oct 8, 2009 7:18am Oct 8, 2009 7:18am

- | Additional Username | Joined Feb 2009 | 51 Posts

- Post #13,266

- Quote

- Oct 8, 2009 9:29am Oct 8, 2009 9:29am

- | Joined Sep 2009 | Status: Member | 18 Posts

- Post #13,267

- Quote

- Oct 8, 2009 10:23am Oct 8, 2009 10:23am

- | Commercial Member | Joined Feb 2008 | 1,440 Posts

- Post #13,269

- Quote

- Oct 8, 2009 9:37pm Oct 8, 2009 9:37pm

- | Joined Jul 2008 | Status: Clear Cut System Trader | 1,111 Posts

- Post #13,270

- Quote

- Oct 8, 2009 10:00pm Oct 8, 2009 10:00pm

- | Commercial Member | Joined Feb 2008 | 1,440 Posts

- Post #13,271

- Quote

- Oct 8, 2009 10:10pm Oct 8, 2009 10:10pm

- | Joined Jul 2008 | Status: Clear Cut System Trader | 1,111 Posts

- Post #13,273

- Quote

- Oct 9, 2009 12:16am Oct 9, 2009 12:16am

- | Joined Jul 2008 | Status: Clear Cut System Trader | 1,111 Posts

- Post #13,274

- Quote

- Oct 9, 2009 12:26am Oct 9, 2009 12:26am

- | Commercial Member | Joined Feb 2008 | 1,440 Posts

- Post #13,275

- Quote

- Oct 9, 2009 12:27am Oct 9, 2009 12:27am

- | Commercial Member | Joined Feb 2008 | 1,440 Posts

- Post #13,277

- Quote

- Oct 9, 2009 3:24am Oct 9, 2009 3:24am

- | Joined Jul 2008 | Status: Clear Cut System Trader | 1,111 Posts

- Post #13,280

- Quote

- Oct 9, 2009 8:35am Oct 9, 2009 8:35am

- | Commercial Member | Joined Feb 2008 | 1,440 Posts