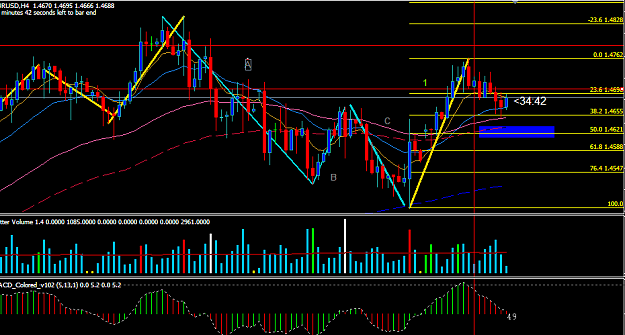

Have a question for the more experienced 4hour traders:

I have had quite a number of trades where a MACD round top above the zero line is forming (for example) and the first MACD line of the round top has formed and then with the next 4 hrs session it looks like the confirmation second down MACD line has formed and I enter but during the session the market goes up and now it is not a round top any longer but it turns into a TC or whatever.

Afterward it is easy to see that it was never a round top but the (false) MACD signal was given and taken at the time of the trade.

At the time the market rhythm was also ok and even the market emotion was a go.

How do you filter out trades like that?

Thanks

T

I have had quite a number of trades where a MACD round top above the zero line is forming (for example) and the first MACD line of the round top has formed and then with the next 4 hrs session it looks like the confirmation second down MACD line has formed and I enter but during the session the market goes up and now it is not a round top any longer but it turns into a TC or whatever.

Afterward it is easy to see that it was never a round top but the (false) MACD signal was given and taken at the time of the trade.

At the time the market rhythm was also ok and even the market emotion was a go.

How do you filter out trades like that?

Thanks

T

Never give up !!!