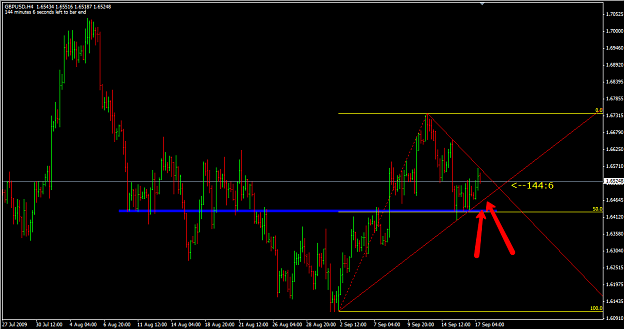

DislikedHey Jarroo i have a question about this trade.

As you can see two Traffic boxes in you chart and you trade was falling right into them right?

But the black filled box shows us some space.

So does that mean that if price make noise and traffic in a particular area and then make some space in that area our trades are safe then before.Ignored

Yes, absolutely. Trades are safer when there is big space (no traffic) no matter how the space is created. This is what Mike is always drilling into our heads. Swing Highs and Swing Lows by there very creation, have space. This allows our setup to have room to move more easily.

Indicators show the past. Price Action "Indicates" the future.