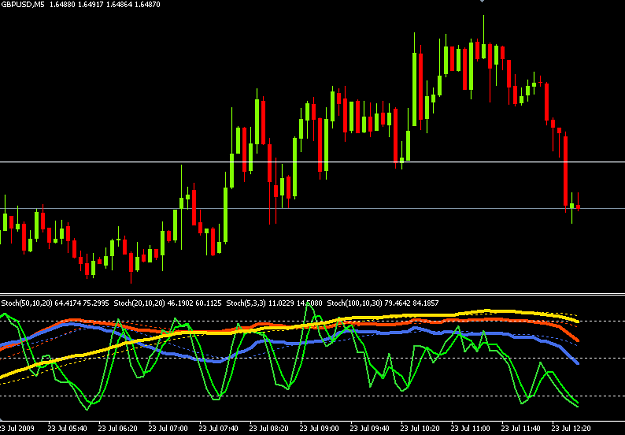

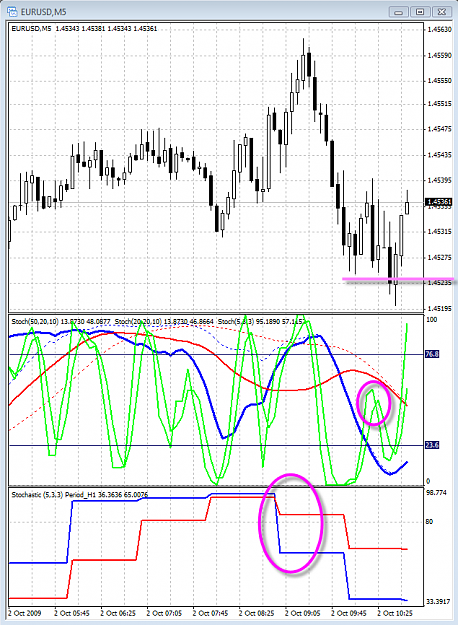

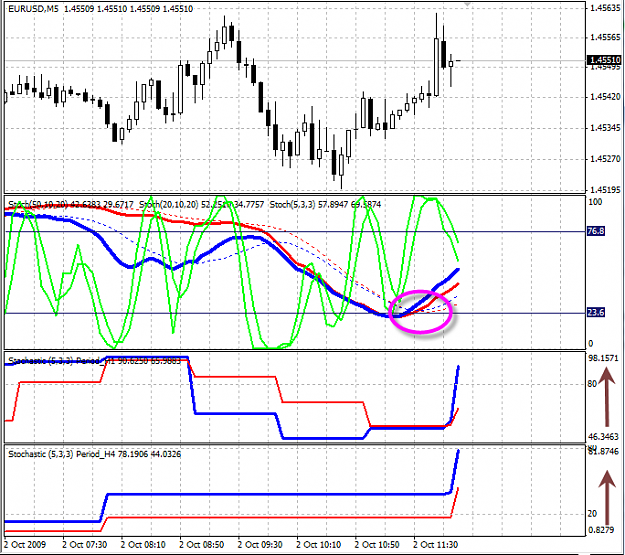

DislikedHey guys, thought i'd post after such a longtime, lucas u have good reason to be a fan of this system, thats because it is a very good profitable one. I've been trading this system for a little while with success....but i recommend just trading the system with the original settings that boxingislife suggested, i've had best results with this and less headache as all i have on my chart is stochastics and i've learnt to understand how they show price action.

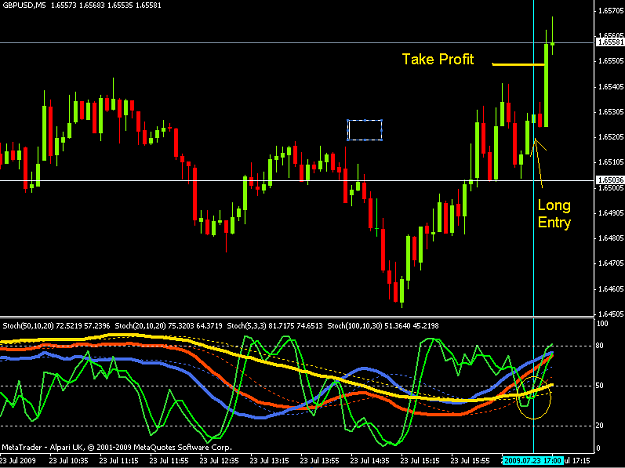

I trade the M5 timeframe with a stop loss of 20 pips and a take profit of 20 pips and this...Ignored

Out of the hundred systems i have been watching on FF this the most sound and logical system i came across,i am mainly focus on the 15M timeframe.

Just has curiosity how many signals in average do you get on GBPUSD M5 timeframe,for the London/NY sessions combines.

Regards

"Everything subject to destruction before even be created"