The past two weeks have been hard to trade in my humble opinion. If you have been able to accurately decipher price action thus far in 2012 - then kudos to you! I have been quite frustrated and hence have spent more hours than a sane person should trying to come up with a low risk way to pull money out of this crazy market.

Fast forward... I have not used CCI in over 3 years and the only reason I started using it was because in an article/interview the words best independent trader (Paul Rotter - PM me if you want a copy of the article) said he used CCI.

Well I have combined CCI with range bars and TMA bands to come up with a little system that should work with any pair, although I have only tested with EURUSD, GBPUSD and US Oil.

Synopsis of the System

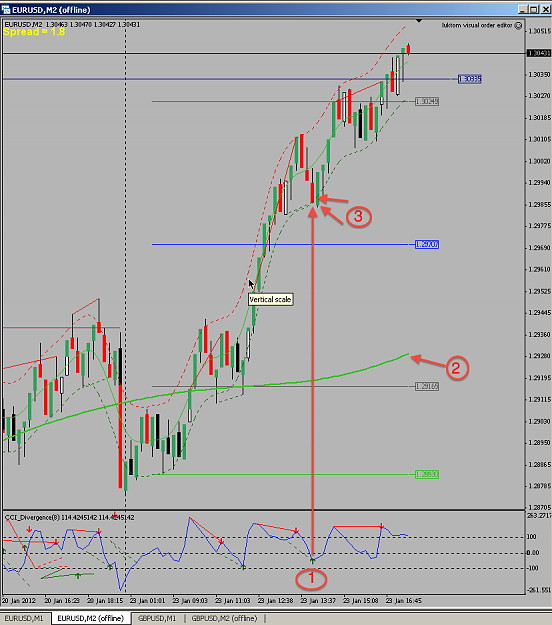

Trade with the trend and look for CCI divergence in the direction of the trend. I use TMA set to 144 to determine the trend - if price is above the TMA ONLY LOOK FOR BULLISH DIVERGENCE and if price is below the TMA ONLY LOOK FOR BEARISH DIVERGENCE.

Once you get a divergence warning, wait for price to extend past the TMA band in the opposite direction of the trend. If you get a bullish CCI divergence, you will want price to drop below the bottom TMA band. This is your signal to enter long. Most of the time, but not always you will get a pin bar piercing the TMA band. I enter with a 6 pip stop and set a target of 12 pips.

The above chart shows todays divergence trade. 1) Bullish divergence 2) P.A. Above 144 TMA and 3) Price drops below lower TMA band.

Fast forward... I have not used CCI in over 3 years and the only reason I started using it was because in an article/interview the words best independent trader (Paul Rotter - PM me if you want a copy of the article) said he used CCI.

Well I have combined CCI with range bars and TMA bands to come up with a little system that should work with any pair, although I have only tested with EURUSD, GBPUSD and US Oil.

Synopsis of the System

Trade with the trend and look for CCI divergence in the direction of the trend. I use TMA set to 144 to determine the trend - if price is above the TMA ONLY LOOK FOR BULLISH DIVERGENCE and if price is below the TMA ONLY LOOK FOR BEARISH DIVERGENCE.

Once you get a divergence warning, wait for price to extend past the TMA band in the opposite direction of the trend. If you get a bullish CCI divergence, you will want price to drop below the bottom TMA band. This is your signal to enter long. Most of the time, but not always you will get a pin bar piercing the TMA band. I enter with a 6 pip stop and set a target of 12 pips.

The above chart shows todays divergence trade. 1) Bullish divergence 2) P.A. Above 144 TMA and 3) Price drops below lower TMA band.