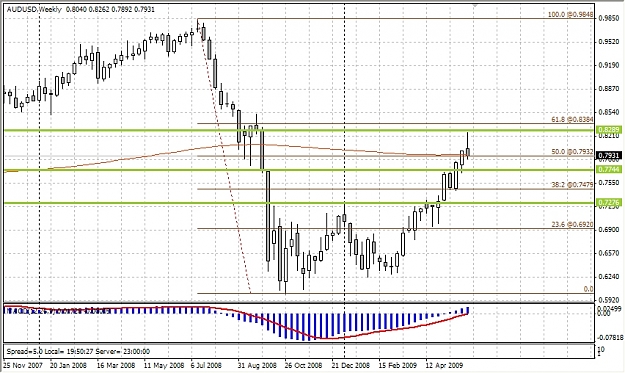

Guys, any thoughts on the Aussie? The weekly shows big rejection with a close back under 80. a move back down to about 75 on a break down of the weekly bar?

- Post #1,841

- Quote

- Jun 5, 2009 4:48pm Jun 5, 2009 4:48pm

- | Joined Jun 2007 | Status: Member | 40 Posts

- Post #1,843

- Quote

- Jun 5, 2009 7:07pm Jun 5, 2009 7:07pm

- | Commercial Member | Joined May 2007 | 7,612 Posts

- Post #1,844

- Quote

- Jun 5, 2009 7:56pm Jun 5, 2009 7:56pm

- | Joined Nov 2008 | Status: Member | 22 Posts

Enter Signature

- Post #1,845

- Quote

- Jun 5, 2009 11:59pm Jun 5, 2009 11:59pm

- | Commercial Member | Joined May 2007 | 7,612 Posts

- Post #1,848

- Quote

- Edited 10:52am Jun 6, 2009 10:27am | Edited 10:52am

Trading: the skill of avoiding trades

- Post #1,849

- Quote

- Jun 6, 2009 11:03am Jun 6, 2009 11:03am

- | Joined Jan 2009 | Status: Member | 1,036 Posts

- Post #1,850

- Quote

- Edited 4:58pm Jun 6, 2009 11:21am | Edited 4:58pm

Trading: the skill of avoiding trades

- Post #1,853

- Quote

- Jun 7, 2009 12:38am Jun 7, 2009 12:38am

- | Commercial Member | Joined May 2007 | 7,612 Posts

- Post #1,854

- Quote

- Jun 7, 2009 12:39am Jun 7, 2009 12:39am

- | Commercial Member | Joined May 2007 | 7,612 Posts

- Post #1,855

- Quote

- Jun 7, 2009 7:33am Jun 7, 2009 7:33am

- | Joined Jan 2009 | Status: Member | 1,036 Posts

- Post #1,858

- Quote

- Jun 8, 2009 3:32am Jun 8, 2009 3:32am

- | Joined Jan 2008 | Status: Member | 632 Posts

D labour of a fool wearieth him cos he doesn't know how to enta d city

- Post #1,860

- Quote

- Jun 8, 2009 6:15am Jun 8, 2009 6:15am

- Joined Feb 2009 | Status: Borderline yahoo & oh-no! | 6,607 Posts