Dislikedthanks for the reply.

then additions have been made to this method? no where in his PDF does he mention we need to pay attention to the 1hr.

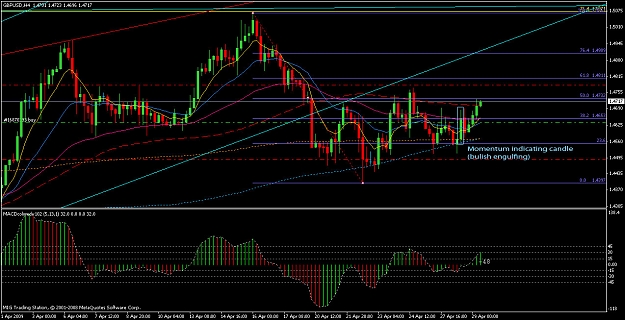

the MA's all seem to be in order for it to go down. are you saying you would not have gone short?Ignored

You can find early entry using H1 or also you can avoid making wrong entry using H1 in this site. You can also watch my post as an example.

Goodluck.