Dislikedgive me back my 24 pips

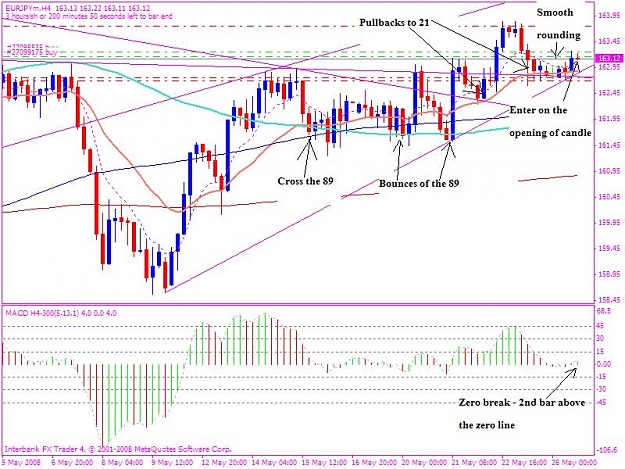

H4 :sell signal,

H1 & M30: pulled back to broken TL and then went away from itIgnored

I also entered short on EURUSD but a bit later, on the next bearish TC on 1H. 1st part reached TP1 at 1.5724. The 2nd is left for 1.5664 but will watch it closely at 1.5710..1.5690 if it finds support there.

Time: 15:00 GMT+1 27/05/08

Price: broke EMA21 and inner sup/res line down on 4H, waiting for a retest of EMA21 and down movement continuation; on 1H broke SMA89 down, retraced back to SMA89 and EMA21 and went down, creating a bearish TC, which was the direct reason for opening; targets: TP1 at the prev. low on 1H, TP2 over SMA200 and supp. line of 4H, at EMA21 on daily, possible reverse at 1.5710..1.5690 (prev. lows on 4H)

Calculations:

Open price: 1.5743x0.5, 1.5738x0.5 ~1.5740x1

SL Price: 1.5781, SL: 41 pips

TP price: 0.5/1.5724, 0.5/1.5764, TP: 46 (16, 76) pips

SINGLE OPENING.

R:R-ratio: 1.12.

Conclusion: trade is Ok.

Edit1: 2nd part close at BE 2,5H after the 1st one; 19 pips x 0.5 + 0 pips x 0.5 = 9.5 pips x 1 lot.

Edit2: if to look at the position about 15 hours later, after closing the 2nd half at BE and turning down price didn't reach TP2 only by 3 pips (TP2 1.5764, the lowest price (bid) in the period - 1.5665). Trade could be in the market still. So it looks like opening was not bad, but SL was a bit too tight.