Igrok,

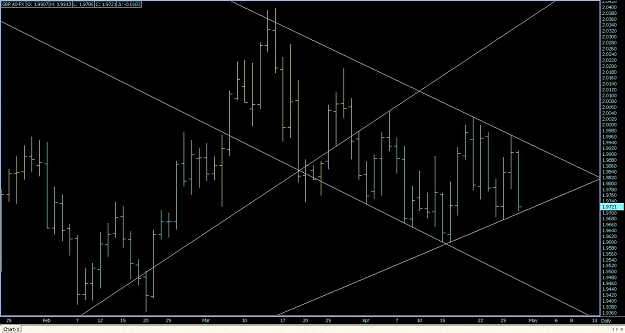

A question on trendlines.

One thing that annoys me is when I draw a trendline on a weekly chart it appears out(not accurate) when I go back to the daily chart.

I'm using Amibroker for my main charting(EOD data) but I even notice the same thing on Metatrader when going from say a 4 hour chart to a 15 min chart, the trendlines drawn on 4 hour will cross the price action on a 15 minute chart.

Do you get the same problem?

A question on trendlines.

One thing that annoys me is when I draw a trendline on a weekly chart it appears out(not accurate) when I go back to the daily chart.

I'm using Amibroker for my main charting(EOD data) but I even notice the same thing on Metatrader when going from say a 4 hour chart to a 15 min chart, the trendlines drawn on 4 hour will cross the price action on a 15 minute chart.

Do you get the same problem?