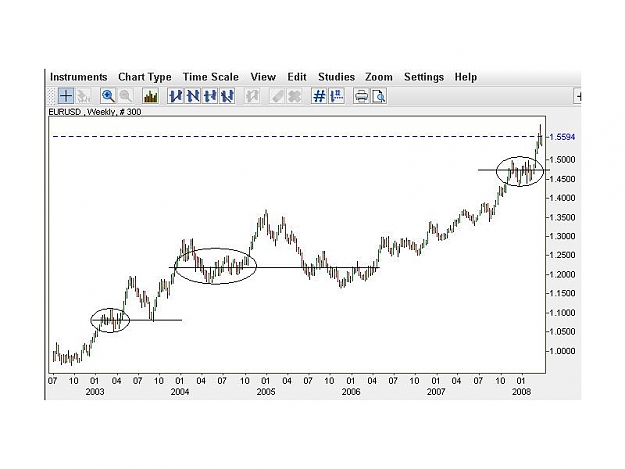

Price is now at weekly pivot.

I tried to tell every one yesterday what was going to happen, and gave very good reason for it to happen.

And when it happens, never fails, there are people who read my posts and still ask "what happened"

I tried to tell every one yesterday what was going to happen, and gave very good reason for it to happen.

And when it happens, never fails, there are people who read my posts and still ask "what happened"