Some analysis (quickly on a Saturday evening):

EURUSD: I agree that it looks like it is in a nice channel between the 89 and 200 MA on the 4 hour. We just got a MACD zero cross on Friday. With the Pin bar on the daily, the MACD on the 4 hour looking bullish, and the 89 a good way above where we currently stand, I feel bullish on this in the early next week.

GBPUSD: On the daily we are near the bottom of a drawn channel I have, a pin bar going through the channel, and then just starting to move away from the bottom of the channel. On the 4H, it appears emotion could be building. Indecision since the bank annouced on Thursday morning. It still appears to be over sold, and the MACD has continued to become more and more positive. Right now on the 4H it is resting at the 8 EMA. I feel bullish on this currency pair, but I fear the breakout will be quick, maybe too quick to catch before it is no longer over sold.

USDJPY: The daily has started a nice uptrend, and the 4H is in a nice uptrend, boucing off of the 8 EMA. I can't believe I didn't get in on this action at all last week. It looks like it could be at a previous point of resistence on the 4H chart. I would expect this pair to come back down to the 8 EMA, and then the MACD will hopefully give us a signal to go long off the 8 EMA, or sit tight and wait for it to come down to the 21 EMA.

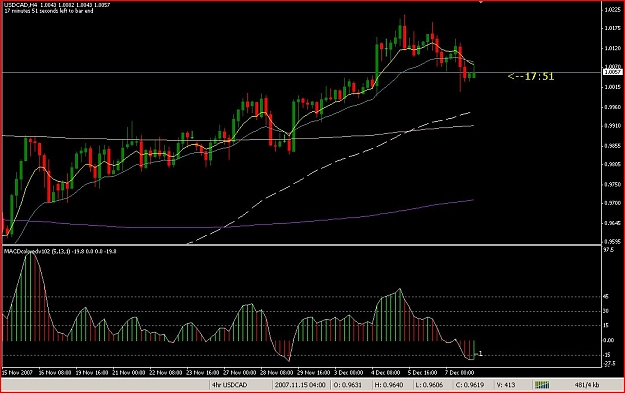

I need to spend more time with this tomorrow and come to better conclusions and look over the USDCHF and USDCAD.

EURUSD: I agree that it looks like it is in a nice channel between the 89 and 200 MA on the 4 hour. We just got a MACD zero cross on Friday. With the Pin bar on the daily, the MACD on the 4 hour looking bullish, and the 89 a good way above where we currently stand, I feel bullish on this in the early next week.

GBPUSD: On the daily we are near the bottom of a drawn channel I have, a pin bar going through the channel, and then just starting to move away from the bottom of the channel. On the 4H, it appears emotion could be building. Indecision since the bank annouced on Thursday morning. It still appears to be over sold, and the MACD has continued to become more and more positive. Right now on the 4H it is resting at the 8 EMA. I feel bullish on this currency pair, but I fear the breakout will be quick, maybe too quick to catch before it is no longer over sold.

USDJPY: The daily has started a nice uptrend, and the 4H is in a nice uptrend, boucing off of the 8 EMA. I can't believe I didn't get in on this action at all last week. It looks like it could be at a previous point of resistence on the 4H chart. I would expect this pair to come back down to the 8 EMA, and then the MACD will hopefully give us a signal to go long off the 8 EMA, or sit tight and wait for it to come down to the 21 EMA.

I need to spend more time with this tomorrow and come to better conclusions and look over the USDCHF and USDCAD.