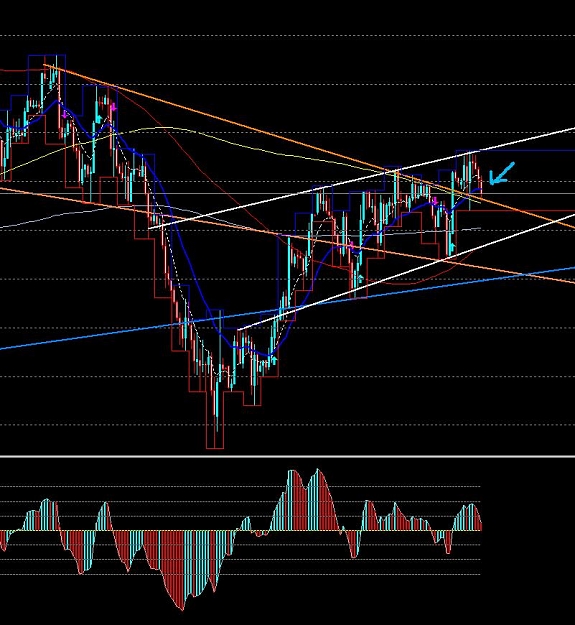

DislikedA long position on eur/usd would have been a winner today.

Unfortunately I didn't notice clear indications to go long.

What would I have had to notice?

MACD lower high?

Thank you.Ignored

Hi ashes,

after the fact it is really easy to see what we could have noticed....so here it goes:

1. the 89 was starting to turn upwards, w/price above the MA (should signal us to look for longs)

2. If we considered market motion...we should have expected price to retrace to the 200 & had an order to enter placed there (this is in anticipation of upmove continuation).

3. The hourly chart shows price moving up and away from the moving averages (especially after 3AM EST).

4. Nadia had it exactly right....she was in w/the initial move yesterday.

Ok, with all that said....let me say the market has been very difficult to watch tonight/this morning. The signs are very obvious now, but really weren't so while they were happening (or I'm just out of it today). I caught a bunch of pips on the move ONLY because of Phillip's 5 min. system. While the signs on the 4 hour were there, I just didn't trust them enough today. You did great by not getting involved in this market today...it's been tough, choppy trading overall. Lots of opportunity...but lots of risk...would have had a hard time figuring my stop for a long based on 4 hour entry....and most likely would have kept it too tight to let the trade develop b/c of the risk environment).

Happy trading!

Pips