No I will not take it.. its too messy... there is a big resistance/trendline just above, its too close to the 200... athough it is in the upper half of the up going channel.. so it might be a countertrend deal... but I wait what happens next and paybe take the next one which should be a TC signal..

Look at the summary files Philip has made some time ago.. he uses trendlines, they are very important together with other things:-)

elmer

Look at the summary files Philip has made some time ago.. he uses trendlines, they are very important together with other things:-)

elmer

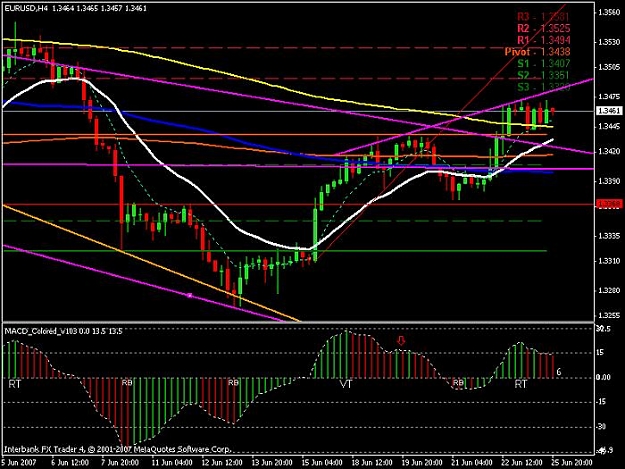

Dislikedis anybody taking the EURUSD 4h MACD turn as a short signal or would you rather ignore this and buy because it's over the 200MA and support ~1,3436/7?

Do you use something like trendlines, support/resistance areas and/or Fibon. retracements at all? I found these traditional techiques of little use in FX compared to indicators like MACD.

TillIgnored