Disliked{quote} Hi M, There is nothing wrong with taking 2 -3R if you are getting a very high win rate. At the end of the day trading is about making money. I will often adjust the TP to within support or resistance so my TP is reached. Sometimes you have watch a 2R or 3R trade turn into a losing trade before it continues to the 7.5R TP (Painful but necessary) but after you get some 7.5R winners and you look at the $ gain win compared to the SL $ you will learn to ride these trades out the distance. Also runners are not 7.5R they are 15, 20,30+ Pts and...Ignored

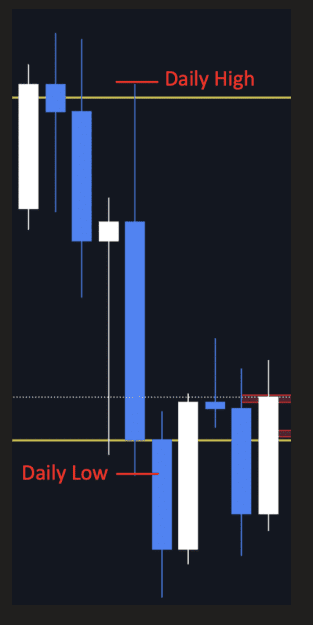

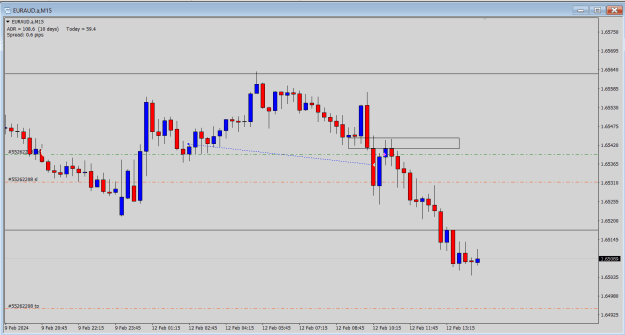

Daily Range = Daily High - Daily Low

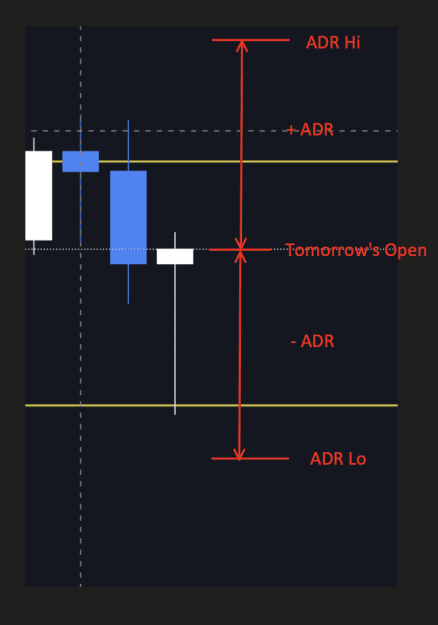

X Day ADR = Sum of previous X days daily ranges / X

10 day ADR = Sum of previous 10 days daily ranges / 10

SMA vs EMA:

Simple Moving Average (SMA): Means that if your ADR has a period of ten days, each day contributes an equal weightage (10%) in the ADR calculation

Exponential Moving Average (EMA): Means that if your ADR has a period of ten days, the most recent day (yesterday, t-1) has the highest weightage, and each less recent day(t-2, t-3.... t-10) contributes a decreasing weightage in the ADR calculation.

For the layman, it means the more recent days matter more, the less recent days matter less.

Which to select (SMA or EMA) for your ADR calculation is personal preference.

Note:

1. Daily range encompasses all trading sessions (Sydney + Tokyo + London + New York)

2. Each particular pair has it's own set of distributions as to which sessions contribute more or less of the movement in a day.

3. 80% of the time, an instrument trades WITHIN it's 20 day ADR, the remaining 20% of the time it trades beyond the ADR

Source for statistic (3): https://www.litefinance.org/blog/for...verage%20value

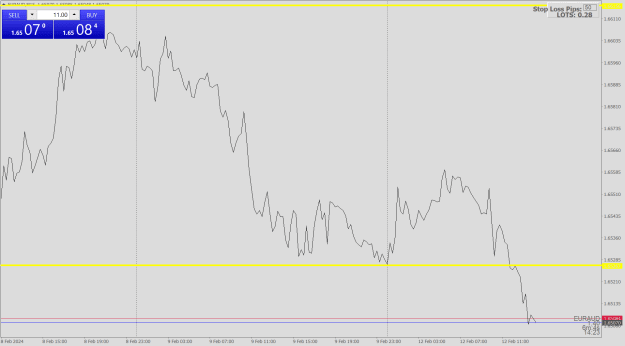

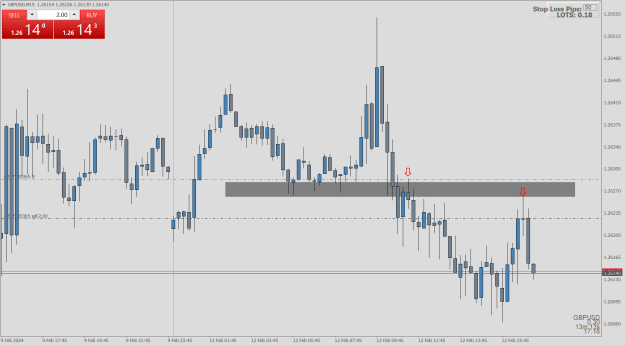

On next day's open, the +/- of the ADR value will be the supposed range of possible movement.

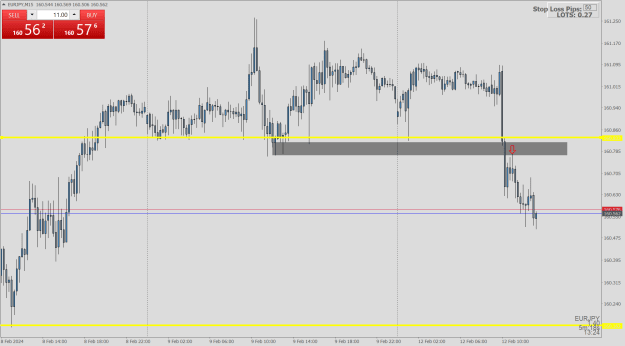

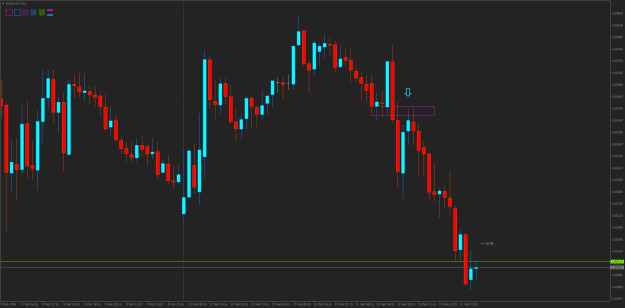

There is no guarantee that it will always stay within the ADR, trading is probabilistic. But if you happen to see a pair trading beyond the high for example, and see a valid set up from the system for a short or vice versa, you can be sure I will be entering that short every single time.

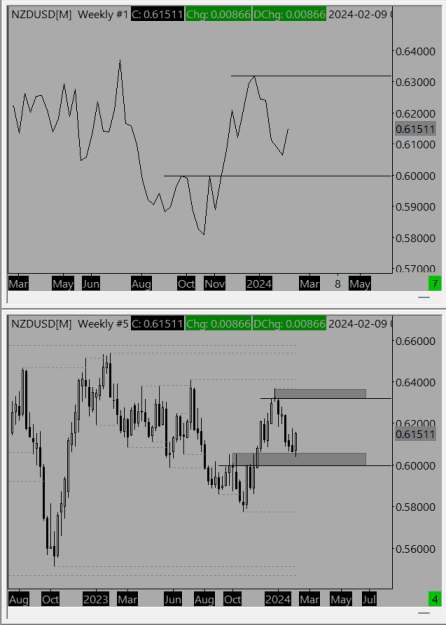

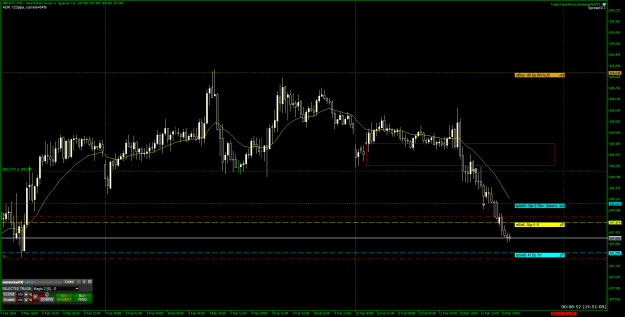

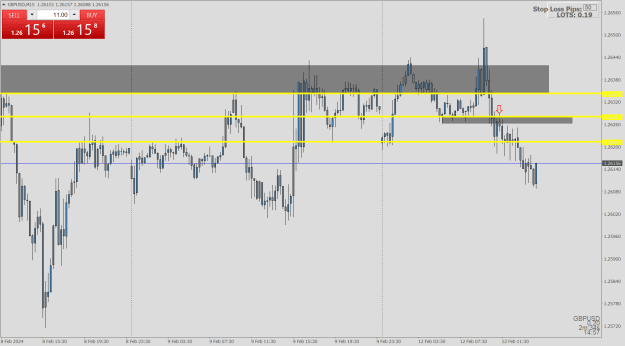

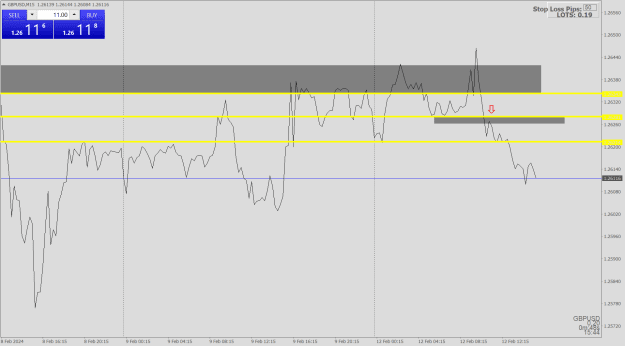

I have attached some helper screenshots for reference. Timeframe is daily.

ADR is just one additional point of information to include in your charting for determining how much room there is for a pair to move, some additional points I look at that you may consider are:

- Session Hi /Lo

- Areas of potential support/ resistance in LTFs

Honestly, there are trades where I entered on a valid setup, but just entered 7.5R as my TP and pray for the best (not the wisest move), resulting in SLs or BEs where I could have taken a 4,5,6R profit and be happily in profit. I'm learning along the way as well, and have some practical position management tips on post #727 update 2, #744 point 3 on splitting your entries you may consider to avoid leaving too much on the table while ensuring you are taking as much profit as you can.

3