Hi fellow Traders!

This is my first time to write a new thread. Would like to share a trading method, which at least made me happy right now because the method is working (at least in Demo account)

I'm in the middle of testing the method in my demo account (it has been running for at least 3 months - fully automated trading), and testing for Live account (it has been running for more than 2 weeks - also in full automated trading).

Introduction

I was in the frustration mode, since the trading way I've learned for soooo long (8 years), never worked! The factor mainly was because I wasn't focused (fully doing my main job during daytime). Well, not like totally not worked, but it was not consistent. A few times worked and gave me profit, but most of the time is not working and gave me big loss. I failed in all of strategies and methods, you name it, I failed on all of that. Technical analysis, News and psychology analysis, ichimoku, bla..bla..bla...bla...method, all are failed. Not because of the method is totally wrong, but I was never had time to do deep learning for each method.

During that time, I found this OLD method in my storage disk as PDF file for a very long time, but I've never read it even tested it, since I was too affraid of loss again and again. And at one point of time I never find any method working OK with me, then I started to look and read carefully the method and implement it as an automated software. And 8 years is a very loooong time when I realized that this method could work, just because I watched the chart for so many times along the way at a different time.

The method was created in Bahasa Indonesia, and was written by somebody (don't know his/her name), "written by www.bursainvesta.com".At least that is the word that is written on the last page. Who created this method? I don't know, but seems too obvious that this method is commonly used by some of the traders. Many thanks to the guy who wrote this to ME! IT IS PROFITABLE! (at least for me)

The Trapping Method

Since the method was written in Bahasa Indonesia, I will just try to translate it to Englsih with some explanation in bracket and italics to elaborate the meanings.

The steps are as described below:

1. Prepare to trade

Prepare to trade when the time is pointing to 10:00am GMT (17:00 Jakarta Indonesia Time) or 11:00am GMT (18:00 Jakarta Indonesia Time), because on that time, the movement range of HIGH (the highest price on that day) and LOW (the lowest price on that day) is steady and ready for implementing this system.

2. Conditions

If on that hours, the range between the running price (honestly, I don't know the meaning of running price, but I suppose this is the Last Price, the median price between Bid and Ask) to HIGH price is more than 10 points, and the range between the running price to LOW price is more than 10 points, and the range between HIGH price and LOW price is less than 70 points (better if it is less than 60 points), then put 2 orders.

An order for BUY STOP providing the price as HIGH price.

An order for SELL STOP providing the price as LOW price.

Both applied with Exit Target (Take Profit) of 10 points (or you can use 20 points), and applied with Stop Loss of 30 points (or 50 points depends on the market conditions) (apparently the writer didn't explain much of what is market conditions that could change the stop loss points).

Note: later I know that this technique (opening 2 opposite positions at the same time) called hedging.

Note: for GBP/USD, the HIGH price to LOW price range can be measured at 90 points (instead of 70 points), and you can use Take Profit at 20 points and Stop Loss at 40 points. This is because this currency pair has the highest movement.

Why using this technique? Because at the time of the New York market is open, we can catch the movement of USD either going up or down. But if the range between HIGH price and LOW price is more than 70 points, be careful because the price could fail to touch HIGH and LOW price, and the profit that we've planned.

You may need to watch the order that you've opened until 05:00pm GMT (24:00 Jakarta Indonesia Time) (well, more or less). Because sometimes there are fundamental news that can be happened at this time range.

If you see the price is moving flat, or no significant news on that day, do not open a new order. As it will return you in a loss.

3. Closure

If one of the position or order is active (this guy writting for users who use AGEA broker and Streamster client, which has order status. The other words for "order is active" is "order of BUY_STOP or SELL_STOP have been changed to BUY or SELL), immediately cancel the other order. For example if the order of BUY is active and moving, then cancel the SELL_STOP order, and the otherwise.

If until 09:00pm GMT (04:00 Jakarta Indonesia Time), none of both orders were changed to active, then you cancel both and start over for the next day's trading.

Return of Investment / ROI (this guy is quite descriptive by giving the ROI calculation)

If you do 1 transaction of 10 points per day, then in 1 week, you'll get return of = 1 x 10 points x 5 days = 50 points, or

50 points x 4 weeks = 200 points per month!

Then if you do trading of $500, that means you'll get return of = 200 points x $0.25 = $50 profit per month, which means 10% for each month or 120% for each year.

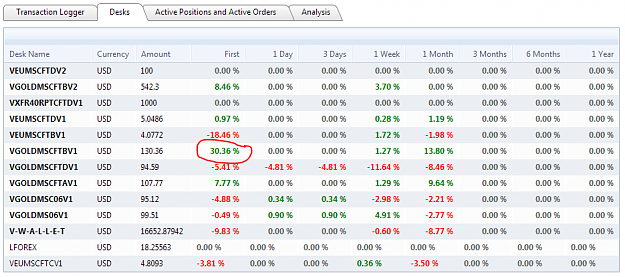

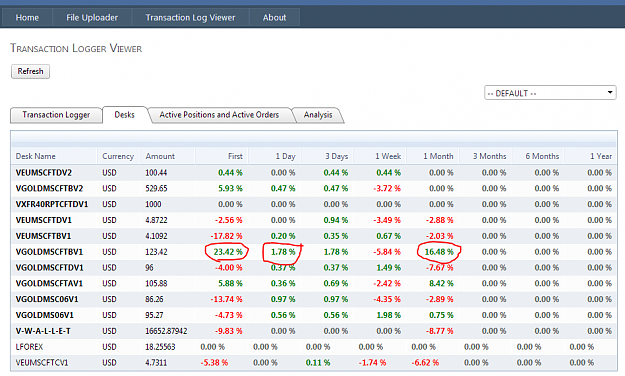

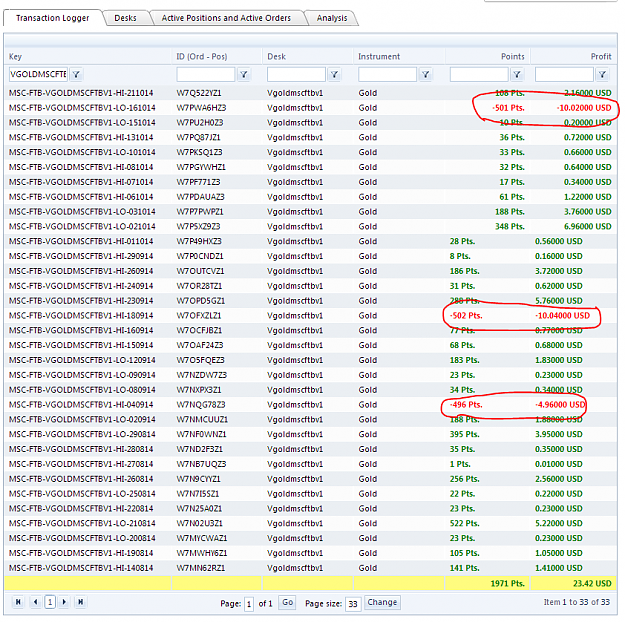

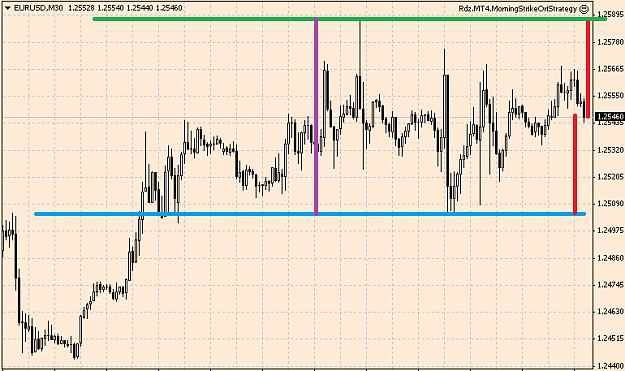

The same method, I've implemented and modified it a little bit, and it was working fine and gave me quite good profit in 1.5 months (arround 30% if you push it to the high lots). Some of it not working and loss, probably because of some parameters is wrong. And below is my return screen capture in Demo Account, with AGEA and Streamster software.

Since I've moved it into automated software, the good point of this is that:

1. No dependencies to the current market condition

Whether buy or sell, never care. Just put there and watch. I don't need to drag lines here and there, counting this and that.

2. Even, I don't need to watch it

The software will do for you. New order, close order, checking conditions... Just drink a coffee somewhere and get profit.

3. Avoiding Loss?

Loss is unavoidable, but holidays is the most dangerous one and should be avoided. Write a condition also to avoid holidays.

And I will also give you the bad of this system:

1. Sideways is my enemy

Yes, since holidays is always resulting in sideways, then this is my enemy. I've noticed that at some point of time, and some currency pairs, there is very RARE situation to get a sideways, even when it's not a holiday. But that's just the pepper in your meal, good to have and to learn the dynamic market.

I hope you get interested on this simple trading method, if you can't find the good one (or too confuse to understand the other's method), you can try this one. Or modify this method and created your own formula! Or you can try with another pair in a different starting time!

You can share or give your thoughts about this method, or post your result here if you already implemented it. Or probably you have a different formula than me.

That can be the formula of when the time you're starting this method, your Take Profit, your Stop Loss, any concerns or modifications about your methods.

UPDATE 9 Nov 2014:

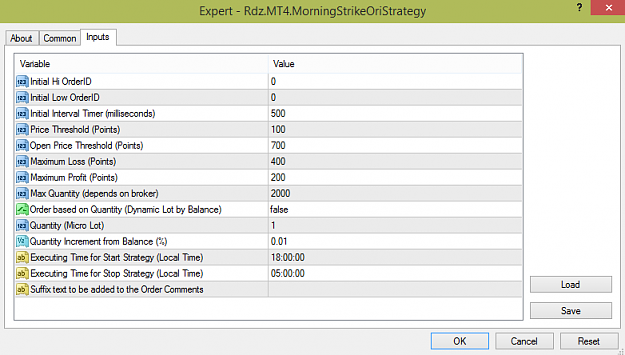

I've uploaded the EA for this strategy, I called it MorningStrike (don't know what is the best name for it). Note that this EA settings is "attached" to forex, not commodities or futures. Note that since this software doesn't recognize holidays, please do it at your own. Stop this EA when running at related market holidays to avoid loss.

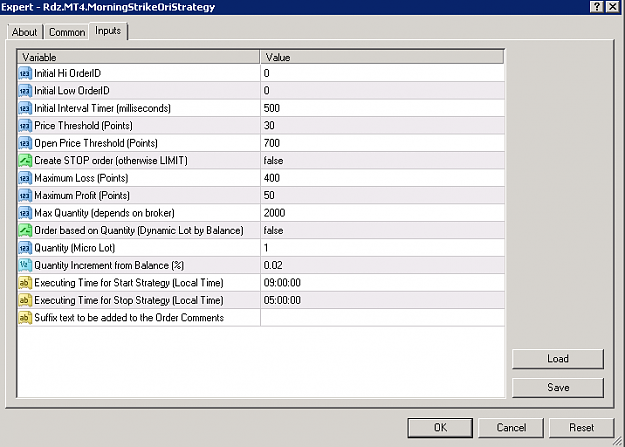

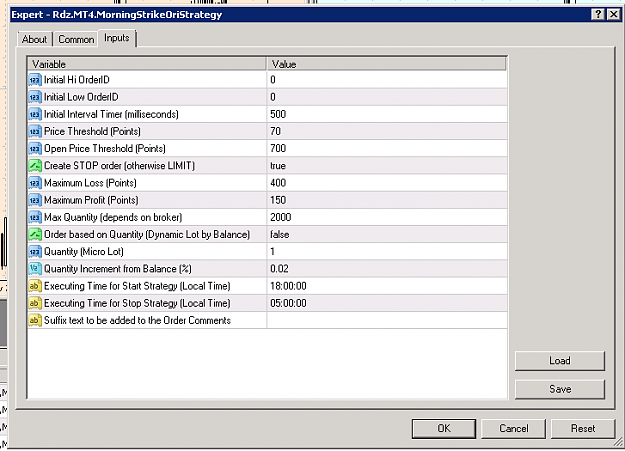

Below are the settings description:

Initial Hi OrderID and Initial Low OrderID > No need to set this to any number. Keep it 0 (zero).

Initial Interval Timer (milliseconds) > Initial timer running. Keep the default number.

Price Threshold (Points) > Is threshold (in points / pips) between Last Price (middle of Ask and Bid Price) and High Price or Low Price of the day.

Open Price Threshold (Points) > Is threshold (in points / pips) between High Price and Low Price of the day.

Maximum Loss (Points) > Max LOSS (Stop Loss)

Maximum Profit (Points) > Max PROFIT (Exit Target)

Max Quantity (depends on broker) > Maximum Quantity (1 quantity = 0.01 lot) for a broker. This settings is to limit the dynamic lot settings below, if the lot already near the max allowed lot. For AGEA broker, the max lot in MT4 is 20 lots (therefore the setting is 2000).

Order based on Quantity (Dynamic Lot by Balance) > Flag, whether order based on Quantity. If true, order lot will be based on fixed Quantity (setting below). If false, order lot will be based on Quantity Increment.

Quantity (Micro Lot) > The Quantity (if setting for Order Based on Quantity is true, this setting is used on lots / volume when creating new order. Value is always fixed.

Quantity Increment from Balance (%) > The Quantity Increment is the settings (in percent %) to get how many lots / volume when creating new order dynamically. Example: Your balance is $5000, then if your Quantity Increment settings is 1 (equal as 1%), your Quantity is 50. System will create order with 0.50 lots. If the Quantity after calculation exceeds Max Quantity, then Max Quantity is used.

Executing Time for Start Strategy (Local Time) > Strategy will be start at. This will be your local time, check your local regional settings in your PC. Default setting is 18:00:00 Singapore Time.

Executing Time for Stop Strategy (Local Time) > Strategy will be stop at. This also will be your local time. Default setting is 05:00:00 Singapore Time.

Suffix text to be added to the Order Comments > You can let this field empty.

DISCLAIMER:

THE SOFTWARE IN THIS PAGE (RDZ.MT4.MORNINGSTRIKEORISTRATEGY.EX4), IS PROVIDED "AS IS" AND MAY BE USED TO AUTOMATE TRADES IN METATRADER CLIENT SOFTWARE ONLY. SINCE THE SOFTWARE IS A FREEWARE, THE SOFTWARE CONTRIBUTOR(S) (THREAD STARTER) NEVER PROVIDE ANY WARRANTIES, THEREFORE THEY NEVER BEAR ANY RESPONSIBILITIES IN CASE OF ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, EXEMPLARY, OR CONSEQUENTIAL DAMAGES, OR ERROR, INCLUDING BUT NOT LIMITED TO LOSS OF USAGE, DATA, OR PROFITS. PLEASE TEST IT FIRST, AND USE IT AT YOUR OWN RISK.

This is my first time to write a new thread. Would like to share a trading method, which at least made me happy right now because the method is working (at least in Demo account)

I'm in the middle of testing the method in my demo account (it has been running for at least 3 months - fully automated trading), and testing for Live account (it has been running for more than 2 weeks - also in full automated trading).

Introduction

I was in the frustration mode, since the trading way I've learned for soooo long (8 years), never worked! The factor mainly was because I wasn't focused (fully doing my main job during daytime). Well, not like totally not worked, but it was not consistent. A few times worked and gave me profit, but most of the time is not working and gave me big loss. I failed in all of strategies and methods, you name it, I failed on all of that. Technical analysis, News and psychology analysis, ichimoku, bla..bla..bla...bla...method, all are failed. Not because of the method is totally wrong, but I was never had time to do deep learning for each method.

During that time, I found this OLD method in my storage disk as PDF file for a very long time, but I've never read it even tested it, since I was too affraid of loss again and again. And at one point of time I never find any method working OK with me, then I started to look and read carefully the method and implement it as an automated software. And 8 years is a very loooong time when I realized that this method could work, just because I watched the chart for so many times along the way at a different time.

The method was created in Bahasa Indonesia, and was written by somebody (don't know his/her name), "written by www.bursainvesta.com".At least that is the word that is written on the last page. Who created this method? I don't know, but seems too obvious that this method is commonly used by some of the traders. Many thanks to the guy who wrote this to ME! IT IS PROFITABLE! (at least for me)

The Trapping Method

Since the method was written in Bahasa Indonesia, I will just try to translate it to Englsih with some explanation in bracket and italics to elaborate the meanings.

** *** **

In this tips, we will use the currency pair EUR/USD, GBP/USD, USD/CHF for example.The steps are as described below:

1. Prepare to trade

Prepare to trade when the time is pointing to 10:00am GMT (17:00 Jakarta Indonesia Time) or 11:00am GMT (18:00 Jakarta Indonesia Time), because on that time, the movement range of HIGH (the highest price on that day) and LOW (the lowest price on that day) is steady and ready for implementing this system.

2. Conditions

If on that hours, the range between the running price (honestly, I don't know the meaning of running price, but I suppose this is the Last Price, the median price between Bid and Ask) to HIGH price is more than 10 points, and the range between the running price to LOW price is more than 10 points, and the range between HIGH price and LOW price is less than 70 points (better if it is less than 60 points), then put 2 orders.

An order for BUY STOP providing the price as HIGH price.

An order for SELL STOP providing the price as LOW price.

Both applied with Exit Target (Take Profit) of 10 points (or you can use 20 points), and applied with Stop Loss of 30 points (or 50 points depends on the market conditions) (apparently the writer didn't explain much of what is market conditions that could change the stop loss points).

Note: later I know that this technique (opening 2 opposite positions at the same time) called hedging.

Note: for GBP/USD, the HIGH price to LOW price range can be measured at 90 points (instead of 70 points), and you can use Take Profit at 20 points and Stop Loss at 40 points. This is because this currency pair has the highest movement.

Why using this technique? Because at the time of the New York market is open, we can catch the movement of USD either going up or down. But if the range between HIGH price and LOW price is more than 70 points, be careful because the price could fail to touch HIGH and LOW price, and the profit that we've planned.

You may need to watch the order that you've opened until 05:00pm GMT (24:00 Jakarta Indonesia Time) (well, more or less). Because sometimes there are fundamental news that can be happened at this time range.

If you see the price is moving flat, or no significant news on that day, do not open a new order. As it will return you in a loss.

3. Closure

If one of the position or order is active (this guy writting for users who use AGEA broker and Streamster client, which has order status. The other words for "order is active" is "order of BUY_STOP or SELL_STOP have been changed to BUY or SELL), immediately cancel the other order. For example if the order of BUY is active and moving, then cancel the SELL_STOP order, and the otherwise.

If until 09:00pm GMT (04:00 Jakarta Indonesia Time), none of both orders were changed to active, then you cancel both and start over for the next day's trading.

Return of Investment / ROI (this guy is quite descriptive by giving the ROI calculation)

If you do 1 transaction of 10 points per day, then in 1 week, you'll get return of = 1 x 10 points x 5 days = 50 points, or

50 points x 4 weeks = 200 points per month!

Then if you do trading of $500, that means you'll get return of = 200 points x $0.25 = $50 profit per month, which means 10% for each month or 120% for each year.

** *** **

The same method, I've implemented and modified it a little bit, and it was working fine and gave me quite good profit in 1.5 months (arround 30% if you push it to the high lots). Some of it not working and loss, probably because of some parameters is wrong. And below is my return screen capture in Demo Account, with AGEA and Streamster software.

Since I've moved it into automated software, the good point of this is that:

1. No dependencies to the current market condition

Whether buy or sell, never care. Just put there and watch. I don't need to drag lines here and there, counting this and that.

2. Even, I don't need to watch it

The software will do for you. New order, close order, checking conditions... Just drink a coffee somewhere and get profit.

3. Avoiding Loss?

Loss is unavoidable, but holidays is the most dangerous one and should be avoided. Write a condition also to avoid holidays.

And I will also give you the bad of this system:

1. Sideways is my enemy

Yes, since holidays is always resulting in sideways, then this is my enemy. I've noticed that at some point of time, and some currency pairs, there is very RARE situation to get a sideways, even when it's not a holiday. But that's just the pepper in your meal, good to have and to learn the dynamic market.

I hope you get interested on this simple trading method, if you can't find the good one (or too confuse to understand the other's method), you can try this one. Or modify this method and created your own formula! Or you can try with another pair in a different starting time!

You can share or give your thoughts about this method, or post your result here if you already implemented it. Or probably you have a different formula than me.

That can be the formula of when the time you're starting this method, your Take Profit, your Stop Loss, any concerns or modifications about your methods.

UPDATE 9 Nov 2014:

I've uploaded the EA for this strategy, I called it MorningStrike (don't know what is the best name for it). Note that this EA settings is "attached" to forex, not commodities or futures. Note that since this software doesn't recognize holidays, please do it at your own. Stop this EA when running at related market holidays to avoid loss.

Below are the settings description:

Initial Hi OrderID and Initial Low OrderID > No need to set this to any number. Keep it 0 (zero).

Initial Interval Timer (milliseconds) > Initial timer running. Keep the default number.

Price Threshold (Points) > Is threshold (in points / pips) between Last Price (middle of Ask and Bid Price) and High Price or Low Price of the day.

Open Price Threshold (Points) > Is threshold (in points / pips) between High Price and Low Price of the day.

Maximum Loss (Points) > Max LOSS (Stop Loss)

Maximum Profit (Points) > Max PROFIT (Exit Target)

Max Quantity (depends on broker) > Maximum Quantity (1 quantity = 0.01 lot) for a broker. This settings is to limit the dynamic lot settings below, if the lot already near the max allowed lot. For AGEA broker, the max lot in MT4 is 20 lots (therefore the setting is 2000).

Order based on Quantity (Dynamic Lot by Balance) > Flag, whether order based on Quantity. If true, order lot will be based on fixed Quantity (setting below). If false, order lot will be based on Quantity Increment.

Quantity (Micro Lot) > The Quantity (if setting for Order Based on Quantity is true, this setting is used on lots / volume when creating new order. Value is always fixed.

Quantity Increment from Balance (%) > The Quantity Increment is the settings (in percent %) to get how many lots / volume when creating new order dynamically. Example: Your balance is $5000, then if your Quantity Increment settings is 1 (equal as 1%), your Quantity is 50. System will create order with 0.50 lots. If the Quantity after calculation exceeds Max Quantity, then Max Quantity is used.

Executing Time for Start Strategy (Local Time) > Strategy will be start at. This will be your local time, check your local regional settings in your PC. Default setting is 18:00:00 Singapore Time.

Executing Time for Stop Strategy (Local Time) > Strategy will be stop at. This also will be your local time. Default setting is 05:00:00 Singapore Time.

Suffix text to be added to the Order Comments > You can let this field empty.

DISCLAIMER:

THE SOFTWARE IN THIS PAGE (RDZ.MT4.MORNINGSTRIKEORISTRATEGY.EX4), IS PROVIDED "AS IS" AND MAY BE USED TO AUTOMATE TRADES IN METATRADER CLIENT SOFTWARE ONLY. SINCE THE SOFTWARE IS A FREEWARE, THE SOFTWARE CONTRIBUTOR(S) (THREAD STARTER) NEVER PROVIDE ANY WARRANTIES, THEREFORE THEY NEVER BEAR ANY RESPONSIBILITIES IN CASE OF ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, EXEMPLARY, OR CONSEQUENTIAL DAMAGES, OR ERROR, INCLUDING BUT NOT LIMITED TO LOSS OF USAGE, DATA, OR PROFITS. PLEASE TEST IT FIRST, AND USE IT AT YOUR OWN RISK.

Attached File(s)

If you ask me to code/fix your EA... it's probably not for free...