Good days versus bad days. Fewer bad days than good days with recovery algorithm (non-martingale) to maintain equity curve. Targeting an average of 1% to 2% per day gains. I've just figured out a way to automate it.

Added and updated thread April 14th, 2024

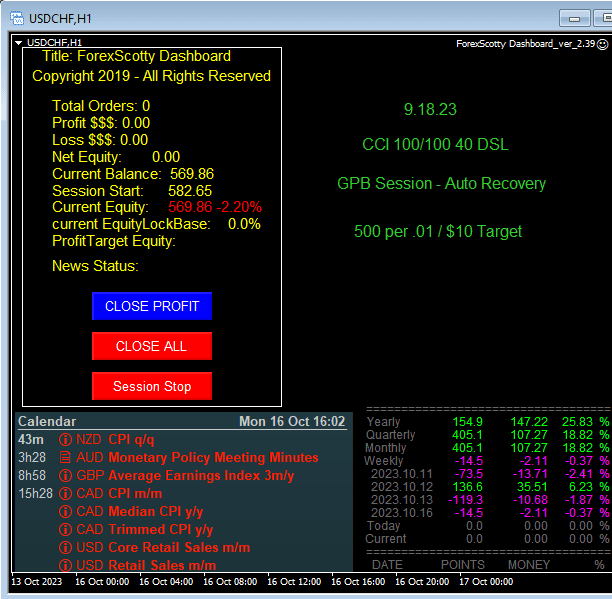

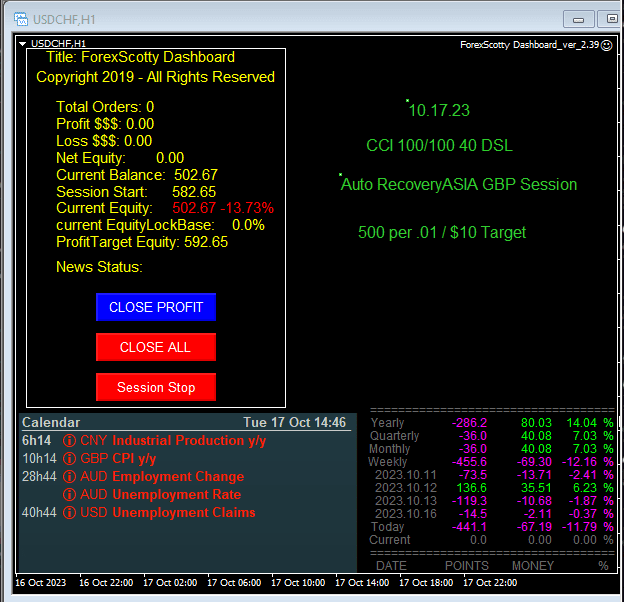

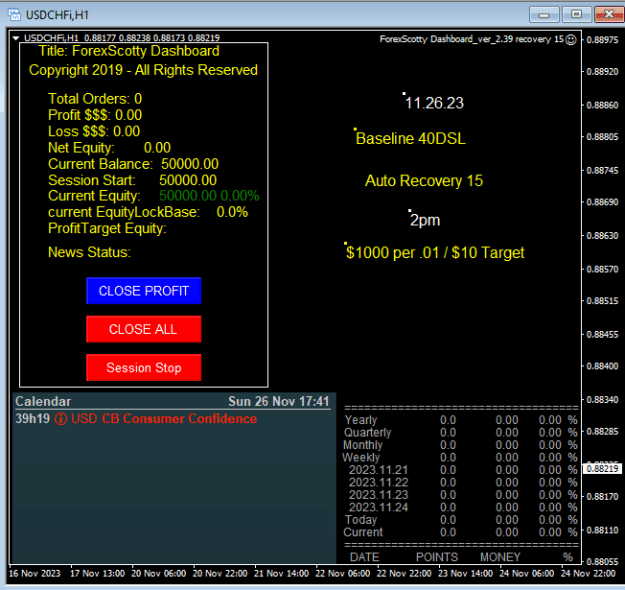

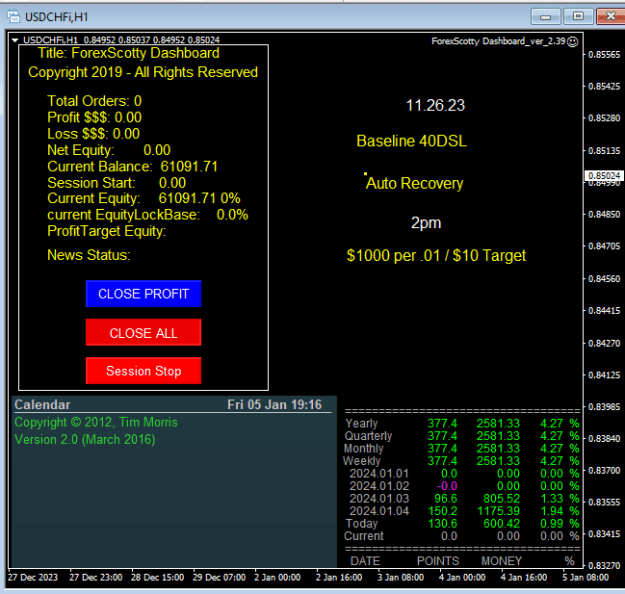

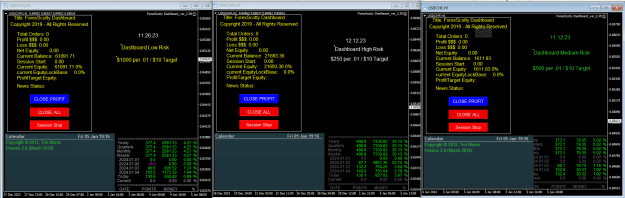

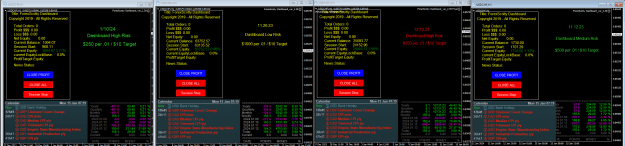

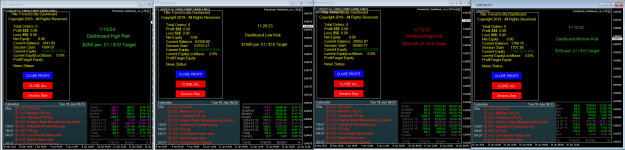

EA uses multiple trades, trending pairs offsetting ranging pairs resulting in a daily account target. When reached, EA shuts down and awaits next day. If not reached, recovery algorithm calculates amount needed to reach target and adjusts lotsize accordingly. As opposed to arbitrary martingale which simply doubles lot size until success or failure.

The failing of most recovery strategies including martingale style is that initial lotsize is calculated on the entire account balance. Latest version now includes a reserve balance that is not included in calculating initial lotsize, therefore allowing more room to recover and keeping reasonable drawdown.

The largest challenge in trading multiple pairs in an algorithm is the inability to back test. Forward live/demo testing is the only option. So, it takes time to view patterns of behavior, make changes, and view the effect. The most stable account set file will be the winner and be used in the managed account this summer.

I'm thinking if it pans out, I really don't want to be in the business of selling EA's. But may consider it as Metatrader is being limited and may become non-existent for US traders. Not sure what options might be available to market something like this. It requires high leverage if high returns are to be expected. Low leverage is fine as well, but the return and equity curve would be lower. As an example...

Leverage 500-1 $1000 Balance Required 1%-2% Average returns per trading day.

Riskier adjustments can be made to the EA.

Leverage 50-1 $10,000 Balance Required .1% Average returns per trading day.

Attempting to only use 5% of account balance (load) maximum to allow for recovery algorithm after losing sessions.

We will see what happens and what opportunities arise...if any.

Currently thinking of new ideas on how to share this EA. I've worked too hard and spent too much money on coding to give it away. I would like to see some return on my work.

There will be a Managed Account available this summer if all pans out.

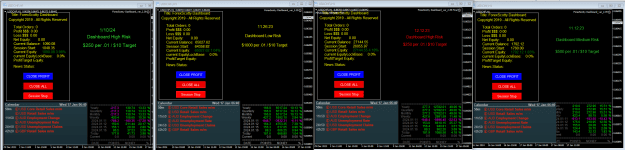

I'm running my test accounts below. All accounts on my profile use the same EA with varied money management settings.

https://www.forexfactory.com/forexscotty

All account stats can be viewed on my profile as only 2 are allowed per thread.

Added and updated thread April 14th, 2024

EA uses multiple trades, trending pairs offsetting ranging pairs resulting in a daily account target. When reached, EA shuts down and awaits next day. If not reached, recovery algorithm calculates amount needed to reach target and adjusts lotsize accordingly. As opposed to arbitrary martingale which simply doubles lot size until success or failure.

The failing of most recovery strategies including martingale style is that initial lotsize is calculated on the entire account balance. Latest version now includes a reserve balance that is not included in calculating initial lotsize, therefore allowing more room to recover and keeping reasonable drawdown.

The largest challenge in trading multiple pairs in an algorithm is the inability to back test. Forward live/demo testing is the only option. So, it takes time to view patterns of behavior, make changes, and view the effect. The most stable account set file will be the winner and be used in the managed account this summer.

I'm thinking if it pans out, I really don't want to be in the business of selling EA's. But may consider it as Metatrader is being limited and may become non-existent for US traders. Not sure what options might be available to market something like this. It requires high leverage if high returns are to be expected. Low leverage is fine as well, but the return and equity curve would be lower. As an example...

Leverage 500-1 $1000 Balance Required 1%-2% Average returns per trading day.

Riskier adjustments can be made to the EA.

Leverage 50-1 $10,000 Balance Required .1% Average returns per trading day.

Attempting to only use 5% of account balance (load) maximum to allow for recovery algorithm after losing sessions.

We will see what happens and what opportunities arise...if any.

Currently thinking of new ideas on how to share this EA. I've worked too hard and spent too much money on coding to give it away. I would like to see some return on my work.

There will be a Managed Account available this summer if all pans out.

I'm running my test accounts below. All accounts on my profile use the same EA with varied money management settings.

https://www.forexfactory.com/forexscotty

All account stats can be viewed on my profile as only 2 are allowed per thread.