INSTRUCTIONS FOR NEWBIES:

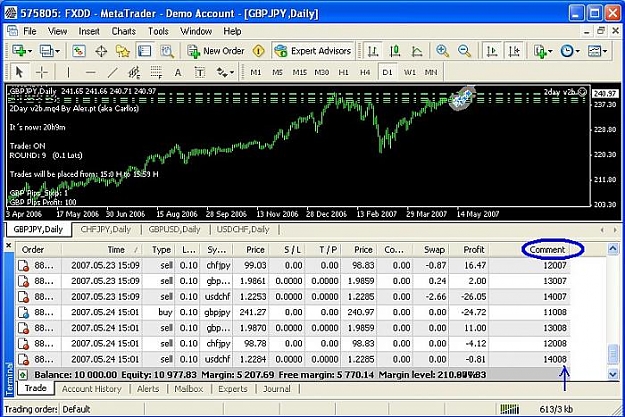

* Open 4 charts, GBPJPY; CHFJPY; GBPUSD; USDCHF;

* I use D1 (not importante);

* Place 2Day EA on all 4 charts;

* Go to Navigator (CTRL+N) --> Expert Advisors --> 2Day EA (Choose the option Modify)

* When MetaEditor is open go here:

extern int hr=15; // change 15 to the hour your want it

//to start placing orders;

extern int min1=00;

extern int min2=59; // After 59 min wont place any more

//orders (u can change this value. I recomend

// that you donīt use less then 15)

extern bool TradeMode = false; //if you want to trade, change

// it to true;

extern int Round=0; // Round 0 places 1 Lot orders;

// Round 1, 2, 3.. places 0,1 Lot orders

* After this, click on COMPILE. There should be 0 Erros and 0 Warnings.

* Close Metaeditor.

Note1: You donīt have to use metaeditor for this. Just click on EA properties on every chart and change the external variables you want. You have to do it on all 4 charts, not just one of them. If you use metaeditor you do it only once and changes take effect on all 4 charts

Note2: After min2 expires you can place orders for next day. All you have to do is change Round to next round: 1,2,3.. till 10; (leave TradeMode =true).

Iīm not a codder so, hope this helps.

alex.pt

* Open 4 charts, GBPJPY; CHFJPY; GBPUSD; USDCHF;

* I use D1 (not importante);

* Place 2Day EA on all 4 charts;

* Go to Navigator (CTRL+N) --> Expert Advisors --> 2Day EA (Choose the option Modify)

* When MetaEditor is open go here:

extern int hr=15; // change 15 to the hour your want it

//to start placing orders;

extern int min1=00;

extern int min2=59; // After 59 min wont place any more

//orders (u can change this value. I recomend

// that you donīt use less then 15)

extern bool TradeMode = false; //if you want to trade, change

// it to true;

extern int Round=0; // Round 0 places 1 Lot orders;

// Round 1, 2, 3.. places 0,1 Lot orders

* After this, click on COMPILE. There should be 0 Erros and 0 Warnings.

* Close Metaeditor.

Note1: You donīt have to use metaeditor for this. Just click on EA properties on every chart and change the external variables you want. You have to do it on all 4 charts, not just one of them. If you use metaeditor you do it only once and changes take effect on all 4 charts

Note2: After min2 expires you can place orders for next day. All you have to do is change Round to next round: 1,2,3.. till 10; (leave TradeMode =true).

Iīm not a codder so, hope this helps.

alex.pt

Attached File(s)

"Hoe ur pips mate?" fxcarllos