Disliked{quote} Mmm I think you are way out on that figure. Remember that the vast majority of challenges are failed so there is no refund and no bonus. They must be making a reasonable profit otherwise they could not stay in business. Anyway it would be great to know the real truth!Ignored

https://myforexfunds.com/myforexfund...ry-statistics/

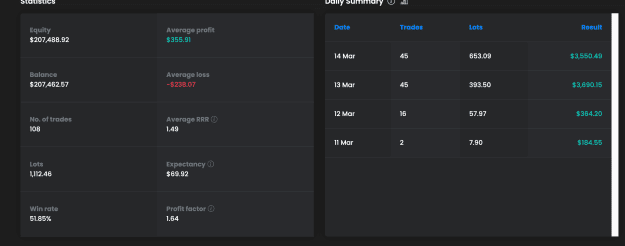

MFF stats are now way better than they were in the past btw.

I also will write the disclaimer: Just because a company makes money, doesn't excuse traders poor trading ability. If its not a prop firm making that money, its a broker. Pick your poison.

6