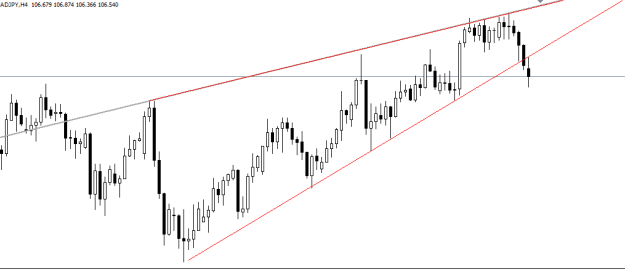

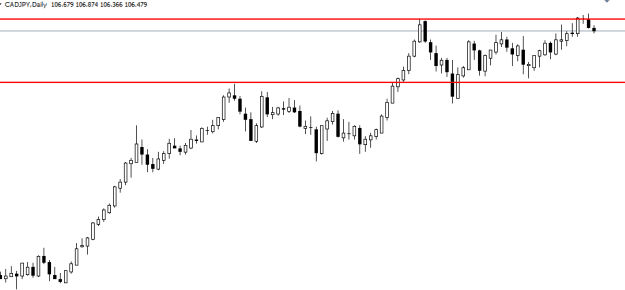

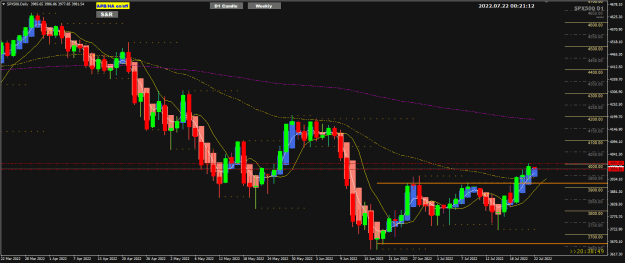

So post some of your charts with trades on them and explain the logic that you used for deciding the entry and exit so that Vincent at least has a chance to study how to apply the required logic for success with the 5-method. He has posted that he has a lot of deficits, such as health problems including mental problems, and these have hindered his journey in life, including failing medical school entrance exam, failing at basic piano playing, and wiping out several trading accounts for thousands of dollars down the tube.

To free Gazans of Hamas, use whatever it takes.