Disliked{quote} All indicators perform well during strongly trending markets. I'm looking for one that also does well when the trend is indecisive. Not found any yetIgnored

No, they do not. For example, stochastics does not perform well in a strongly trending market: It will go overbought (or oversold) and can stay there for a lot of bars. During that phase, it is of no value at all for helping to decide on making an entry.

I'm looking for one that also does well when the trend is indecisive.

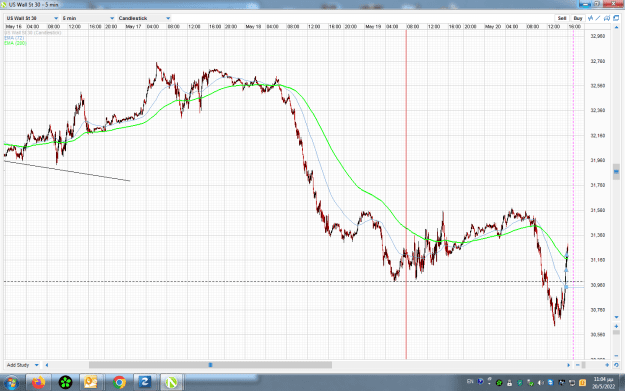

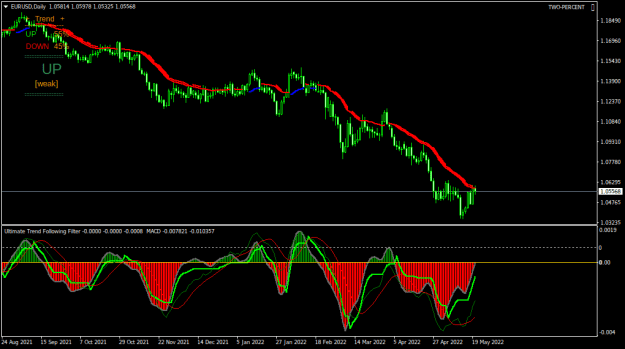

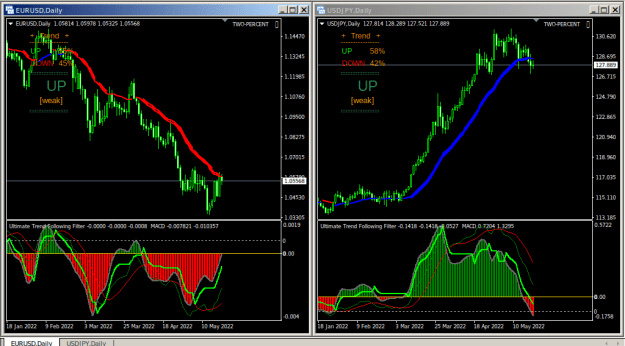

Why in the world would you want to be trading on a TF that is showing an indecisive trend???? If I don't see a decisive trend on a TF, then I simply keep moving to smaller TFs until either I find one or I reach M1. If none found, then I simply wait until M1 displays one (change comes from the bottom and progresses upward).

To free Gazans of Hamas, use whatever it takes.

1