Once i read this trick from an ex senior bank trader on twitter, the real one. I took note but quickly forgot about it.

I accidentally find it to day.

So let explained the idea it by a story. You can skip this and scroll to below part.

The rise & fall in exchange rate doesn't reflex the change in fundamental quality of phone A & B. It should be 1.05 as before.

But the sudden, large market order injected into market make this exchange rate temporary.

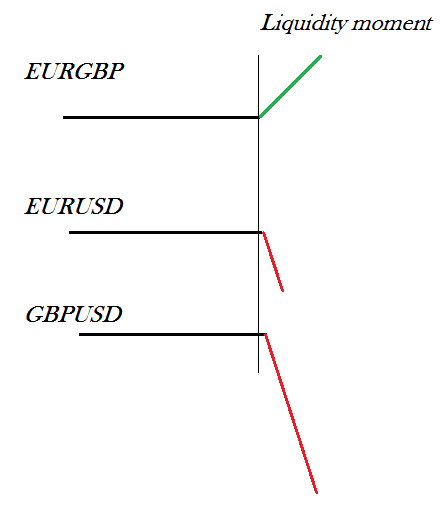

Take EURUSD, GBPUSD & EURGBP as an example.

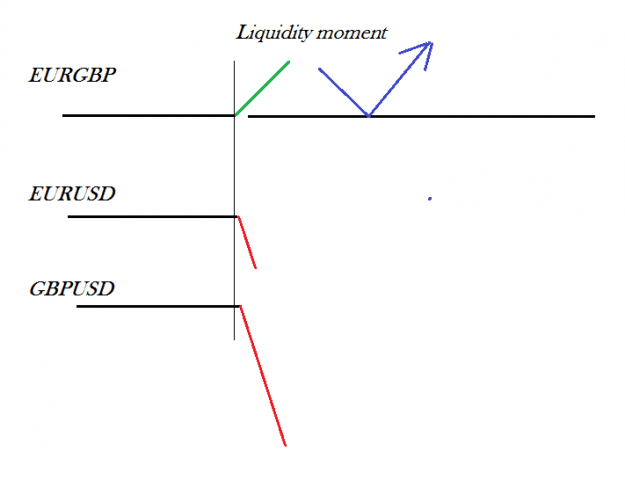

I call the moment when large market order injected to the market which causes big movement as "Liquidity moment". As we all know the reason for market to move is "Lack of liquidity". That is, if you want to buy a real estate and nobody sell at this price - lack of liquidity at this price - then you have to buy at that much higher price.

So we have large USD sell market order suddenly injected to the market, cause a sudden change in EURGBP rate.

Fundamentally, there is (almost) nothing change before & after that moment.

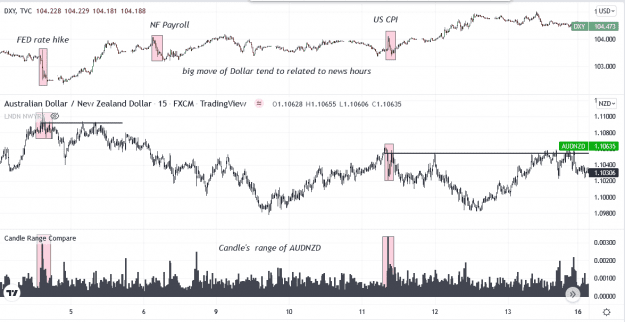

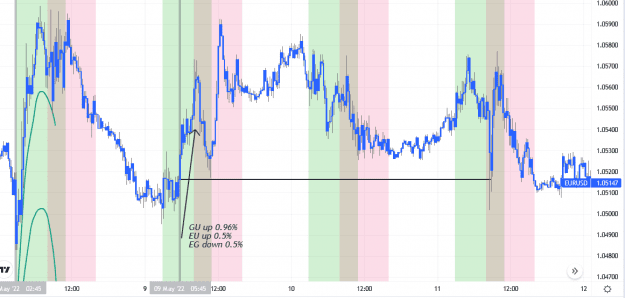

Example in real chart

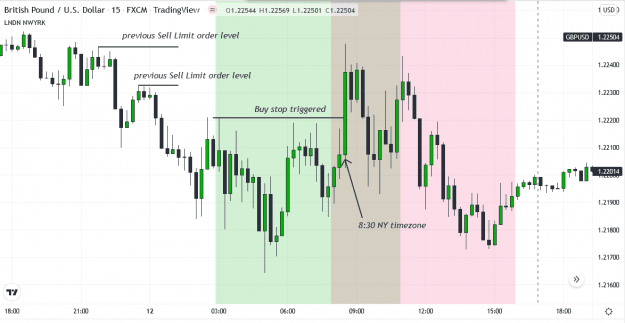

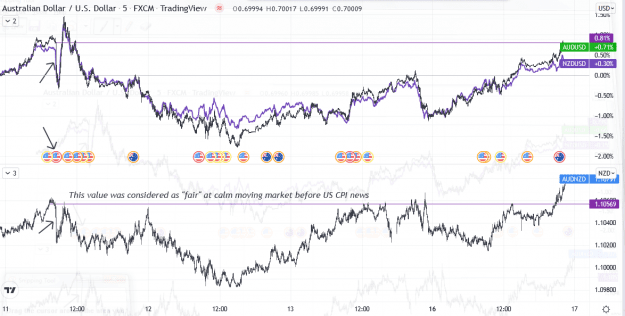

I use NY (GMT-4) chart. This is M15 chart.

It's May 12, M15 candle at 8:37 am NY time. Btw this is the intersection of London & NY sessions.

You can see this large bullish candle cut through bunch of equal highs above. So we can guess that bunch of buy stop will be triggered, adding fuel to the fire and push price up even more to these level above it.

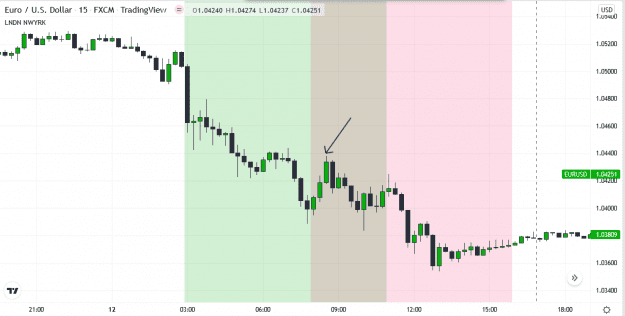

We have the same price action on EURUSD

Large Dollar sell order injected into market, pushing both GBP & EUR up.

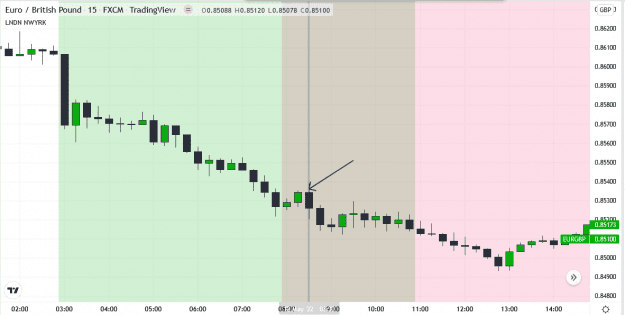

And the Side effect: EURGBP down.

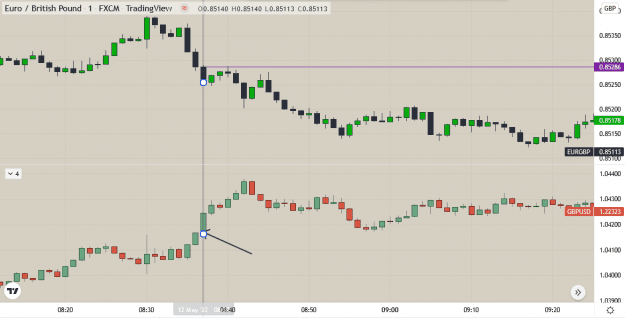

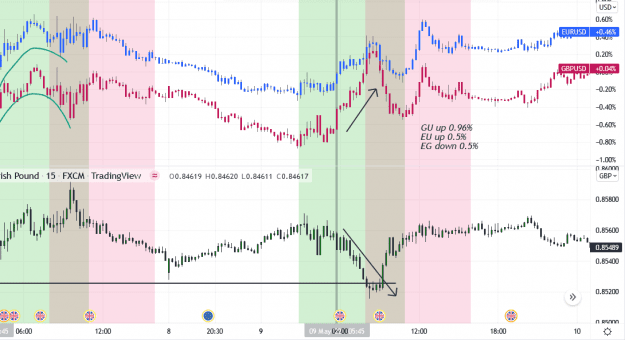

i zoom into 1 minute chart here:

you can see the M1 candle, in GBPUSD chart it break out to upside and triggered Buy stop.

The Side effect is EURGBP down.

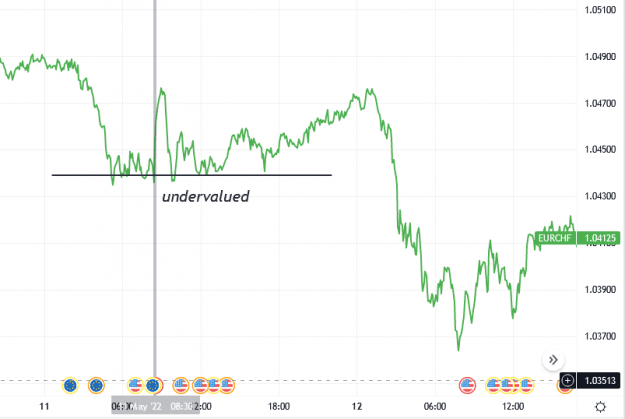

The trick is we consider the opening price as relative fair value, as price level prior to Liquidity moment.

EURGBP down, and also many wave of intraday speculation follow. We have an intraday downtrend on this pair.

But remember, the key level still above that opening price, prior to Liquidity moment.

I marked it at 0.8528 level.

This level is respected the very next day on May 13. Price touched it slightly and dropped immediately like a stone.

I accidentally find it to day.

So let explained the idea it by a story. You can skip this and scroll to below part.

QuoteDisliked"Suppose the town has 2 mobilephone store: Store A & Store B. They sell exact the same kind, same quality, identical in everything & from the same importer.

QuoteDislikedStore A often sells it with their premium insurance plan (let's call it phone A), so normally phone A is 5% more expensive than phone from store B (let's call it phone B).

as exchange rate of phone A/phone B = 1.05

Normally!

Because it isn't 1.05 in some occasions. Say the guy just win a lottery and he want to buy 500 smartphone to give away to everyone in town. This large amount of buy (market) order injects to the market.

The supply side, on the other hand, only 2 store.

The guy is a gentleman, so he choose "with premium insurance" phone as a gift. He goes to store A and buy 50% of their stock.

Suddenly A fear that they'll run out of stock. They have to increase price a little (because they also want to satisfy other customers).

The exchange rate A/B now (temporaryly) is 1.10

And the guy has to step into store B and buy the rest, because 1.10 is too expensive to him, comparatively.

Store B, after watching this overnight millionaire about to buy everything, they also increase price.

Eventually both phone A & B rise in price.

The exchange rate A/B falls back to 1.05

He turn back to store A and keeps buying because his demand still not fully satisfied."

The rise & fall in exchange rate doesn't reflex the change in fundamental quality of phone A & B. It should be 1.05 as before.

But the sudden, large market order injected into market make this exchange rate temporary.

Take EURUSD, GBPUSD & EURGBP as an example.

I call the moment when large market order injected to the market which causes big movement as "Liquidity moment". As we all know the reason for market to move is "Lack of liquidity". That is, if you want to buy a real estate and nobody sell at this price - lack of liquidity at this price - then you have to buy at that much higher price.

So we have large USD sell market order suddenly injected to the market, cause a sudden change in EURGBP rate.

Fundamentally, there is (almost) nothing change before & after that moment.

Example in real chart

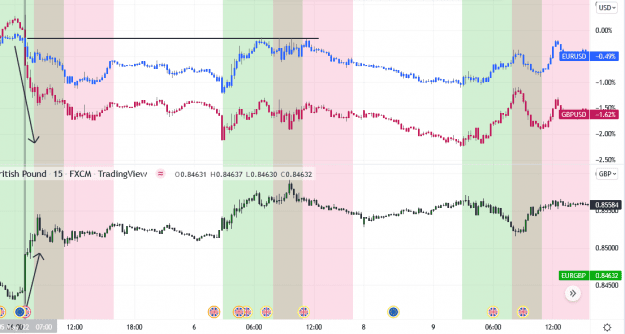

I use NY (GMT-4) chart. This is M15 chart.

It's May 12, M15 candle at 8:37 am NY time. Btw this is the intersection of London & NY sessions.

You can see this large bullish candle cut through bunch of equal highs above. So we can guess that bunch of buy stop will be triggered, adding fuel to the fire and push price up even more to these level above it.

We have the same price action on EURUSD

Large Dollar sell order injected into market, pushing both GBP & EUR up.

And the Side effect: EURGBP down.

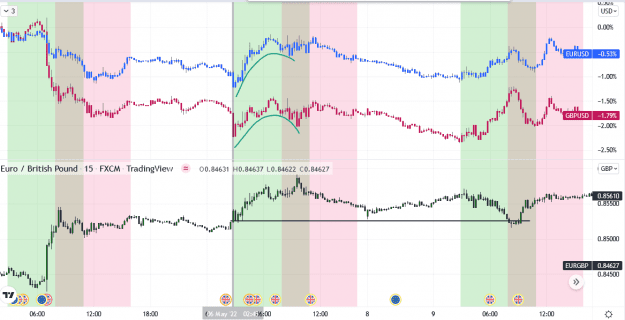

i zoom into 1 minute chart here:

you can see the M1 candle, in GBPUSD chart it break out to upside and triggered Buy stop.

The Side effect is EURGBP down.

The trick is we consider the opening price as relative fair value, as price level prior to Liquidity moment.

EURGBP down, and also many wave of intraday speculation follow. We have an intraday downtrend on this pair.

But remember, the key level still above that opening price, prior to Liquidity moment.

I marked it at 0.8528 level.

This level is respected the very next day on May 13. Price touched it slightly and dropped immediately like a stone.