Hello everyone

I have decided to make this thread,

So I'll get this out of the way first,

I'm not guaranteeing anything you will lose like 95% of traders do,

And I will not be held responsible for any of your losses,

You trade at your own risk.

And I'm not trying to tell experienced traders how to trade,

I thought I would do this for new traders who have yet to pick up on the basics,

And if any experienced traders who would like to contribute,

You are welcome,

I know what it's like starting at the very beginning,

knowing nothing about what you are doing,

I've been doing this since 2011, So I picked up quite a lot.

I'm no expert and I cannot write any sort of code,

But it's the little things at first that you struggle with like.

How do you use the MT4 platform,

How many of you know that a trendline can be as long or as short as you want it.

It doesn't have to belong all the time, you can change it in the settings,

I will show you a way to confirm the trades I make,

I have a moving average and currency strength.

I will use divergence lines apart from that, it's quite simple.

The moving average will give you your entry point.

This will be backed up by the currency strength and the chart setup

What I hope to show you is some easy tips,

I noticed the other week that someone had set an EA running,

And this EA was set for 20 pairs, And two of them I noticed were buy orders for EUR/USD and USD/CHF,

(This is why I thought of this thread,)

I'm not going to say they both cannot win,

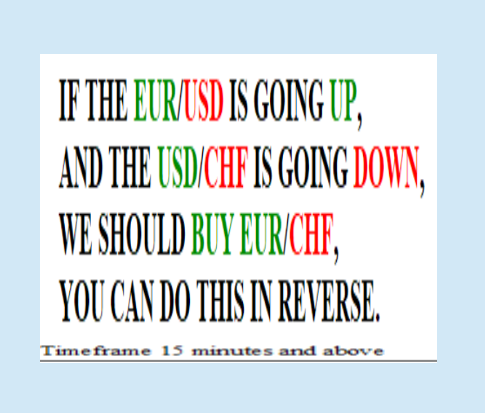

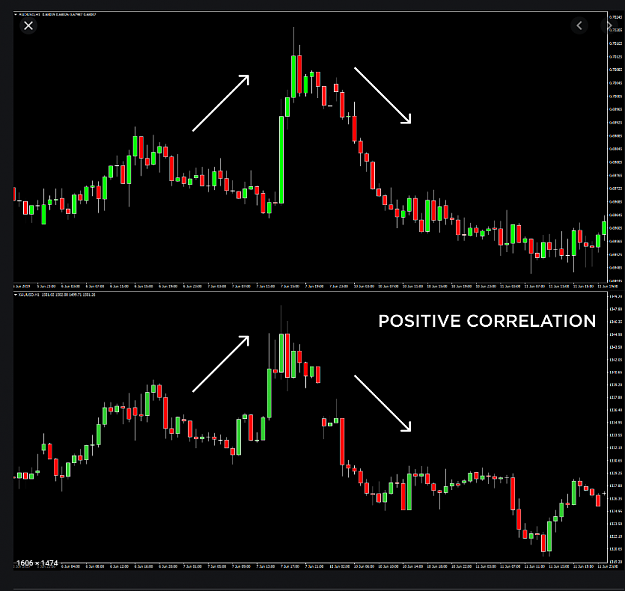

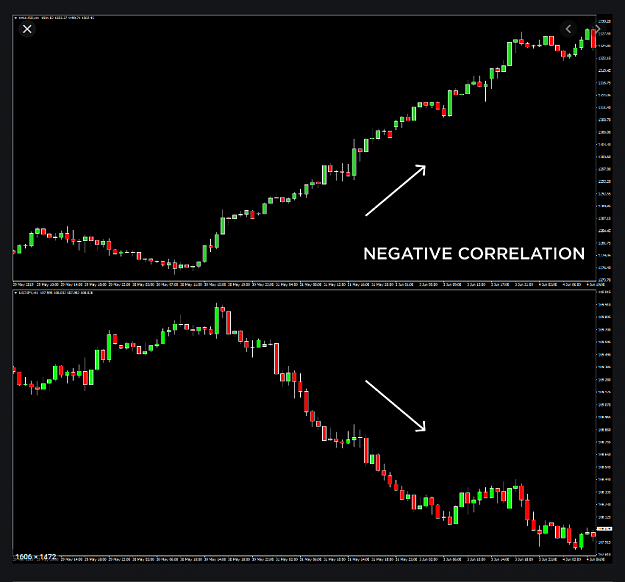

But this is the sort of trade. When you see EUR/USD going up,

You sell USD/CHF,

So we have traders out there who are betting against themselves,

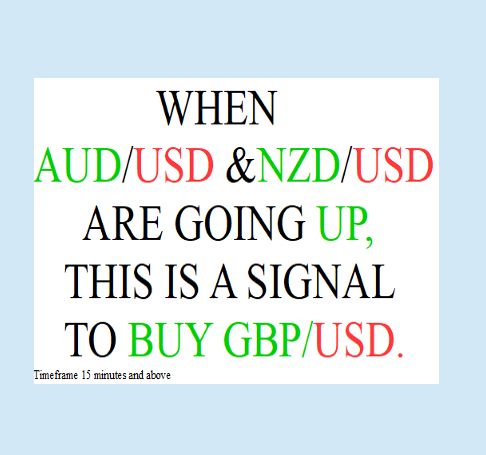

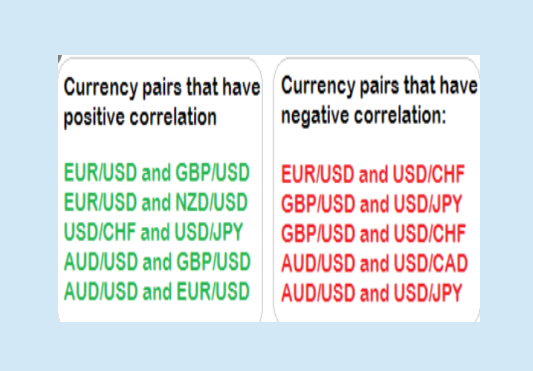

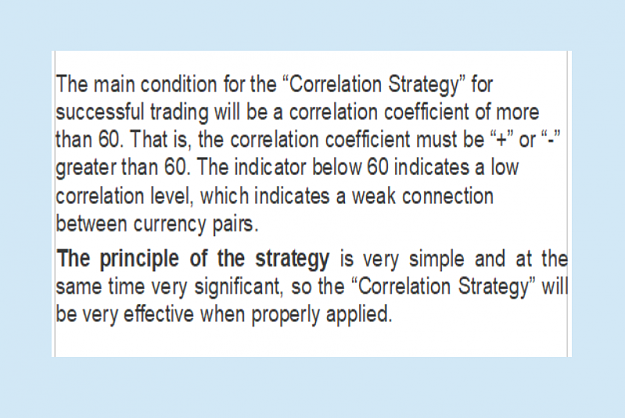

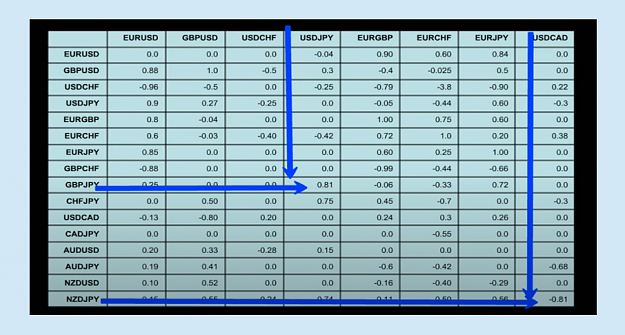

I'm talking about the correlation of pairs,

And there are A few rules, such as the one I just mentioned.

I won't be doing a lot of writing,

But I hope to put some pictures of charts on at least once a day,

Question one Where do you entry

I use The moving average 21 exponential When you see it crossing to the other side of the candle.

Question two. What do you use to support your entry?

I use the currency strength indicator and the moving average.

The rest is hard to explain I will show you on the chart

Question three you will ask me how I place 3 pairs on the same chart

I will show you on the chart.

So good luck to everyone and stay safe,

I have decided to make this thread,

So I'll get this out of the way first,

I'm not guaranteeing anything you will lose like 95% of traders do,

And I will not be held responsible for any of your losses,

You trade at your own risk.

And I'm not trying to tell experienced traders how to trade,

I thought I would do this for new traders who have yet to pick up on the basics,

And if any experienced traders who would like to contribute,

You are welcome,

I know what it's like starting at the very beginning,

knowing nothing about what you are doing,

I've been doing this since 2011, So I picked up quite a lot.

I'm no expert and I cannot write any sort of code,

But it's the little things at first that you struggle with like.

How do you use the MT4 platform,

How many of you know that a trendline can be as long or as short as you want it.

It doesn't have to belong all the time, you can change it in the settings,

I will show you a way to confirm the trades I make,

I have a moving average and currency strength.

I will use divergence lines apart from that, it's quite simple.

The moving average will give you your entry point.

This will be backed up by the currency strength and the chart setup

What I hope to show you is some easy tips,

I noticed the other week that someone had set an EA running,

And this EA was set for 20 pairs, And two of them I noticed were buy orders for EUR/USD and USD/CHF,

(This is why I thought of this thread,)

I'm not going to say they both cannot win,

But this is the sort of trade. When you see EUR/USD going up,

You sell USD/CHF,

So we have traders out there who are betting against themselves,

I'm talking about the correlation of pairs,

And there are A few rules, such as the one I just mentioned.

I won't be doing a lot of writing,

But I hope to put some pictures of charts on at least once a day,

Question one Where do you entry

I use The moving average 21 exponential When you see it crossing to the other side of the candle.

Question two. What do you use to support your entry?

I use the currency strength indicator and the moving average.

The rest is hard to explain I will show you on the chart

Question three you will ask me how I place 3 pairs on the same chart

I will show you on the chart.

So good luck to everyone and stay safe,