[quote=RobinHood;14000140]{quote} Hi Paul, Thank you for your post. The best news is that it is only a demo account.

Morning RH,

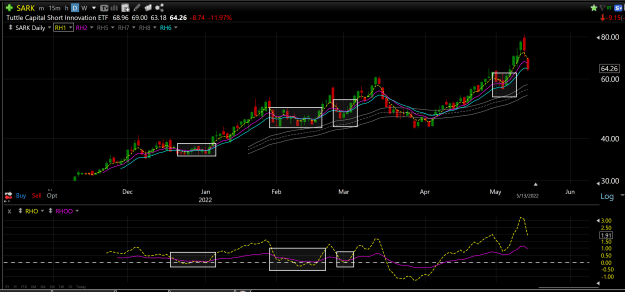

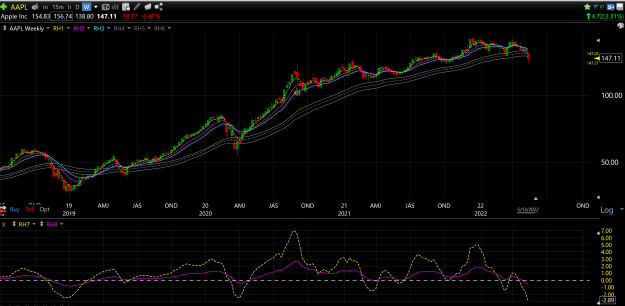

ARKK chart Dly. Can this ETF be sold short, I recall a conversation we had where shorting was allowed, if so this was a nice tradeable ETF.

I also look forward to your reply, to enhance my knowledge, especially comments relating to Continuation trades on the ARKK chart.

Ben

Morning RH,

ARKK chart Dly. Can this ETF be sold short, I recall a conversation we had where shorting was allowed, if so this was a nice tradeable ETF.

I also look forward to your reply, to enhance my knowledge, especially comments relating to Continuation trades on the ARKK chart.

Ben