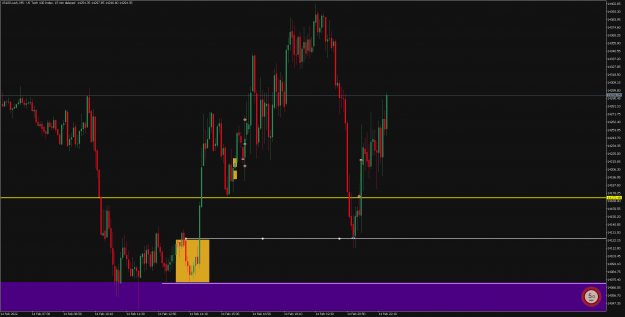

Disliked{quote} Cycles are Fractal System, every TF has a trading cycle, but smaller TF Cycle will be within a bigger one and so on. even in the same TF, there is multi cycles according to the Law of Vibration, the bigger cycle might have multi cycles of a smaller one. so, he mentioned the trade cycle without identifying what TF. {image} cheers,Ignored

You're great in giving excellent answer.

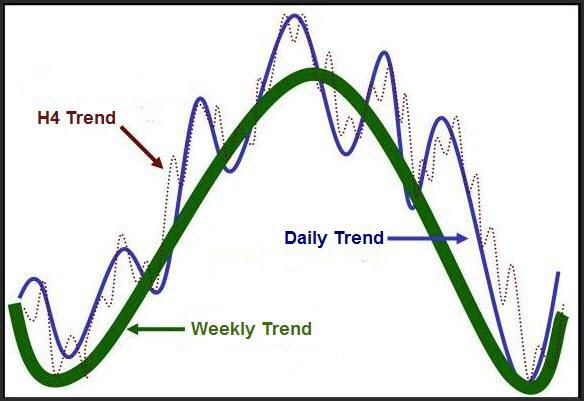

To add to that point, the real power lies in the congruence of factors from a top-down approach, aiming to have as many aligning in our favor as possible.

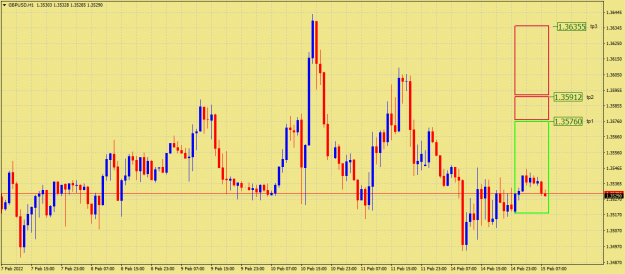

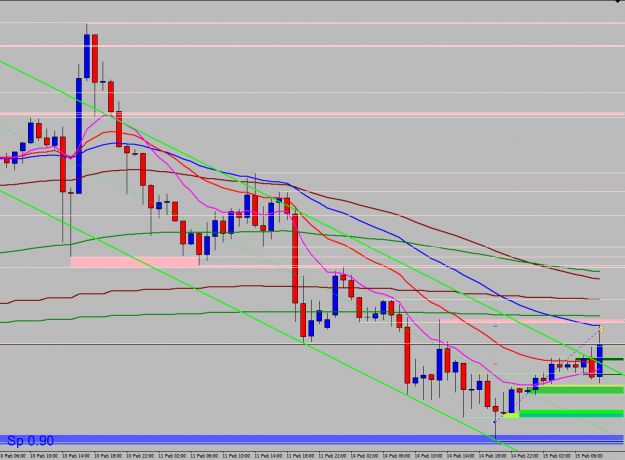

In the example, the down cycle in the hourly had the backing of the H4 and daily cycles as well, which undoubtedly reinforces the chances of picking the right direction to trade.

Now, does this mean that the bearish market structure in the hourly will be respected?

Not at all.

Remember that each individual trade is just a random event within the context of an exploitable edge.

However, by conducting the proper market structure analysis, we do obtain that edge in terms of the location to engage that can offer a relatively low-risk entry for a potentially much larger yield. Anything below 30 pips risk is good entry location.

I come from the future.