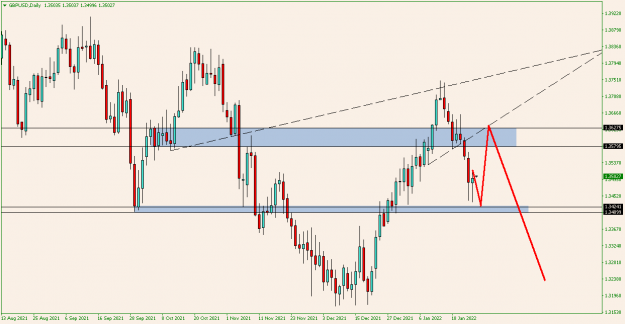

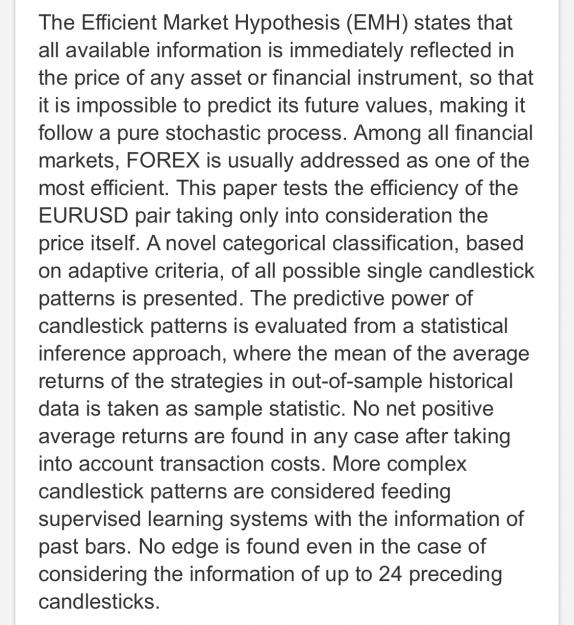

Disliked{quote} This is not something you backtest. In other words, backtesting is pretty much useless when it comes to candlestick patterns. That being said, using the Daily chart, look for engulfing candles, outside bars (similar to engulfing but not necessarily the same), pin bars/long wicks at key areas of support and resistance. A great way to find support and resistance is to use the zig zag indicator, and set it at 2,2,1. Use the weekly chart to plot areas of support and resistance.Ignored

I make my own luck.

1